Key takeaways

- As realized returns begin to align more closely with expected ROI, more midsize company CFOs plan to increase their investments in AI over the next five years. At the same time, more companies are bringing their AI development and usage in-house.

- An afterthought in prior surveys, agentic AI has risen to become a major catalyst of AI usage in 2025. For both midsized companies and PE firms, top use cases include cybersecurity, fraud detection, and financial planning and analysis.

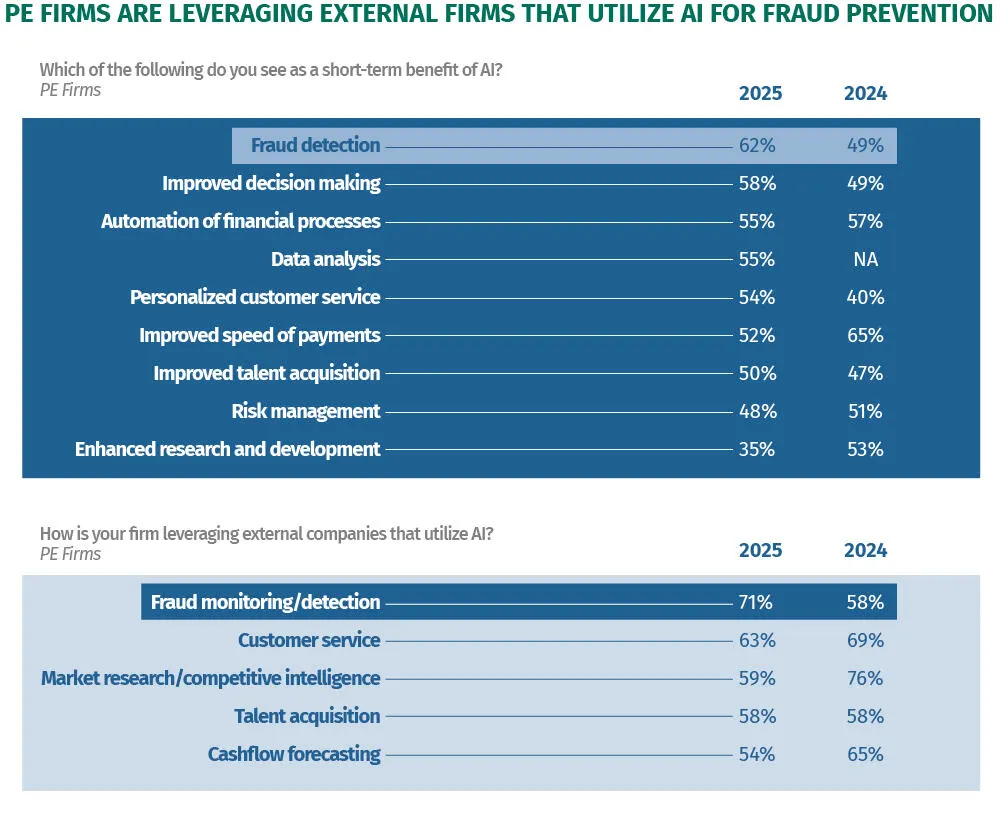

- Fraud prevention remains a top AI use case for both midsize companies and PE firms. Middle-market organizations are using AI for cybersecurity, customer identification, and real-time transaction monitoring. PE firms frequently outsource their fraud monitoring services to AI-enabled third parties.

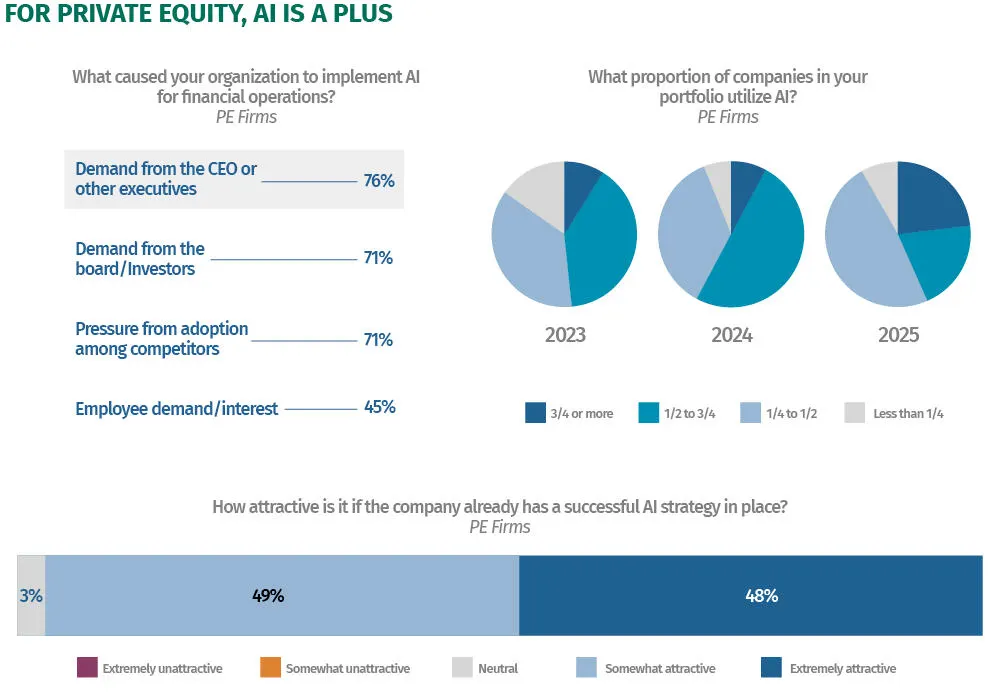

- PE firms are actively seeking to add AI-optimized companies to their portfolios, in response to increasing demand from their C-suite, board, and investors.

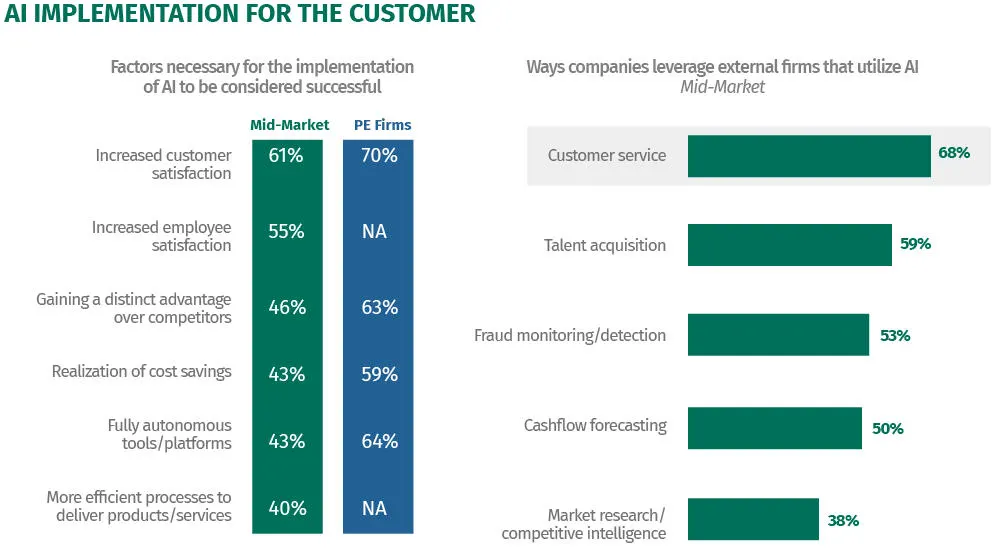

- Customer satisfaction has emerged as a critical measure of success for AI implementation projects. In addition, "enhancing customer service" leads the list of top three motivating factors for implementing AI in the operations.

Excitement For AI Builds Across The Enterprise

For mid-sized companies, momentum for AI adoption and investment is building. Citizens' third annual survey of how U.S. midsize company CFOs and private equity (PE) leaders are using AI offers insights into the growing excitement and acceptance of this technology throughout the organization—from back-office staff to the C-suite. The research demonstrates how these firms are capturing financial process improvements as realized returns on investment (ROI) approach expectations.

Key themes from this year's research include the explosive growth of agentic AI in a wide range of use cases, from cybersecurity and fraud detection to financial reporting. Both midsize companies and PE firms are viewing customer satisfaction as a critical metric for determining the success of any AI project. And more PE firms are seeking portfolio companies that have already deployed a successful AI strategy in their operations.

In this report, we explore how CFOs and PE firms are using AI in finance today, and share their plans for the future deployment of this maturing technology.

-

"As mid-market companies begin to capture greater ROI and efficiency gains from their AI projects, they are starting to see results that match the lofty promise of this transformative technology. In response, more firms are planning to bump up their investments in AI over the next few years."

Mark Lehmann

Vice Chair of Citizens Commercial Bank

AI Adoption and Investment Momentum Grows

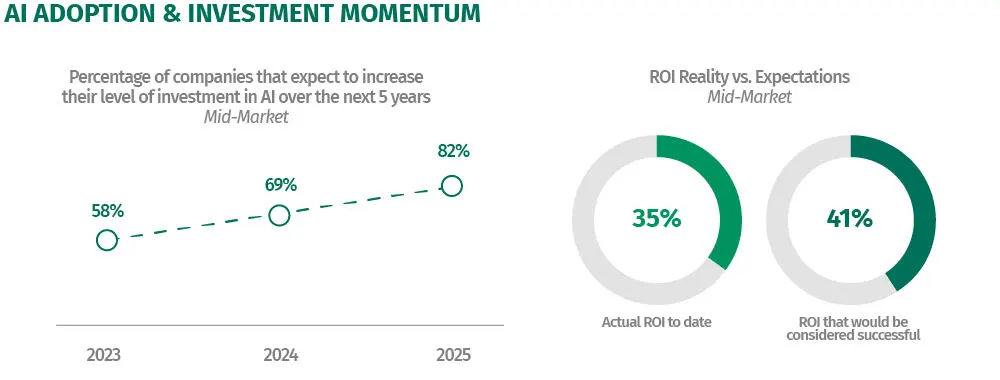

The proportion of midsize companies (defined as organizations with annual revenues between $50 million and $1 billion) that plan to increase their AI investments over the next five years has increased over the past three surveys, from 58% in 2023 to 82% in 2025.

Just as importantly, midsize companies are seeing their realized ROI begin to match their lofty expectations. In 2025, respondents reported an average 35% ROI, a figure approaching the 41% they state would be needed to consider their AI investments a success. Furthermore, 61% of midsize company CFOs agree that AI has made financial processes easier, a significant uptick from prior years (just 38% in 2024).

Firms replace outsourcing with internal development and usage

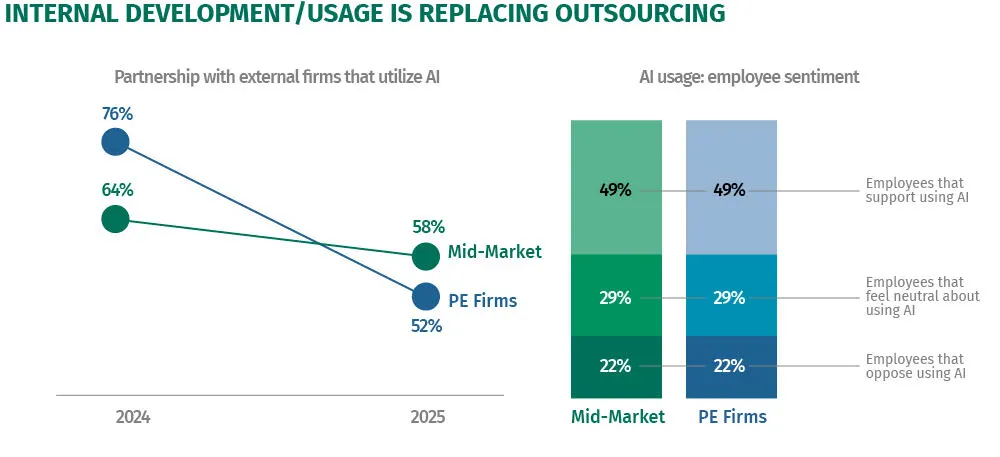

This growing enthusiasm around deploying AI is driving more companies to bring their development in-house, a trend most notable among PE firms. The percentage of midsize company CFOs that have partnerships with external firms that utilize AI declined from 64% in 2024 to 58% in 2025, while for PE firms, the figure has fallen from roughly three-quarters (76%) to slightly over half (52%).

Concurrent with this trend is a growing acceptance of AI usage among employees, as fewer than a quarter of staff at both midsize companies and PE firms now oppose using AI in the workplace.

The Rise of Agentic AI

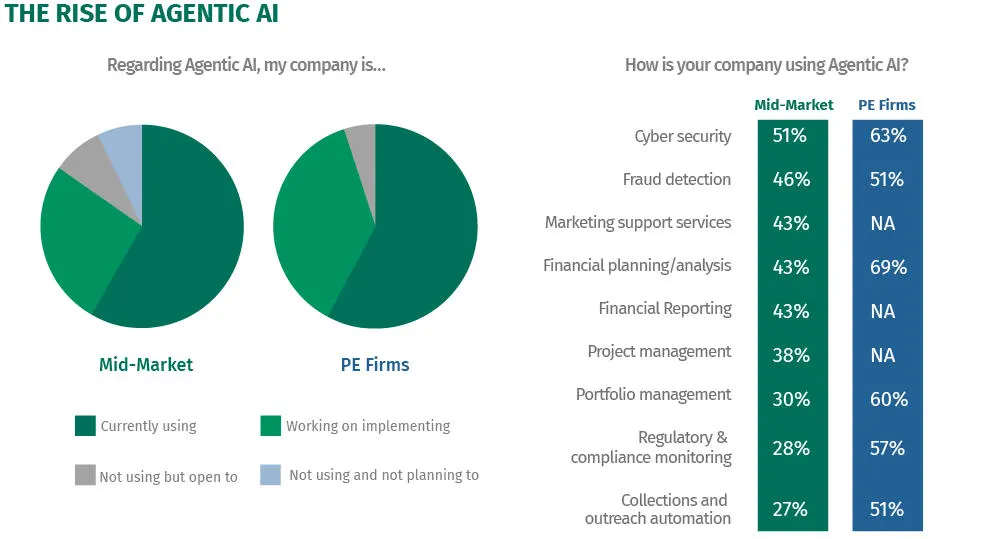

An unknown in prior surveys, agentic AI appears ready for its closeup in 2025. This year, 82% of midsize companies and 95% of PE firms have either begun or plan to implement agentic AI in their operations in 2026. This emerging technology has proven adept for a variety of financial use cases. Both midsize companies and PE firms are leveraging this technology for cybersecurity, fraud detection, and financial planning and analysis. Mid-market companies are also deploying agentic AI for marketing support services, while PE firms are seeing success in portfolio management, regulatory compliance monitoring, and collections outreach.

Of those organizations that have already adopted agentic AI, nearly all (99%) agree it has improved their operational efficiency and workforce productivity.

-

"Agentic AI is shifting financial operations from process-driven workflows to outcome-driven automation. As AI takes on more autonomous actions, strong human oversight and governance are essential. With the right guardrails, agentic AI can unlock new levels of speed, accuracy, and insight across everything from commercial lending to regulatory reporting."

Michael Ruttledge

Chief Information Officer and Head of Enterprise Technology & Security at Citizens

How Companies Are Using AI for Fraud Prevention

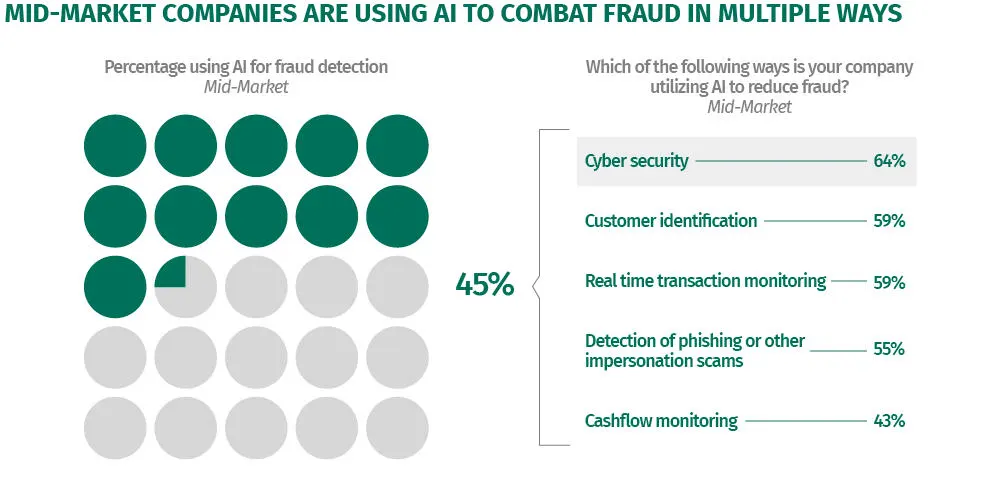

Consistent with prior surveys, fraud prevention continues to be a major AI use case for both midsize companies and PE firms.

Midsize companies deploy AI to fight fraud in multiple ways

Among midsize companies, 45% are currently using AI for fraud detection, a slight decrease from 2024 (48%), but higher than the 35% reported in 2023. These organizations use AI in a variety of fraud-fighting scenarios, including cybersecurity, customer identification, real time transaction monitoring, and phishing or other impersonation scam detection.

PE firms partner with external firms that utilize AI for fraud prevention

A higher percentage of PE firms identified fraud detection as a short-term benefit of AI in 2025 (62%) as compared with 2024 (49%). Furthermore, fraud monitoring and detection is the primary way PE firms are partnering with external firms that utilize AI (71% in 2025, versus 58% in 2024), bucking the overall trend of bringing more AI use cases in-house.

-

"AI is rewriting both sides of the fraud playbook. Bad actors and small-time fraudsters are using it to launch sharper attacks with convincing deepfakes and tailored phishing. At the same time, it’s also arming firms with smarter defenses to spot risks early, stop threats in real time and build client trust."

Michael Cummins

EVP, Head of Treasury Solutions and Payments

For Private Equity, AI is a Plus

With encouragement from the C-suite, board, and investors, PE firms are demonstrating a growing interest in adding AI-enabled companies to their investment portfolios.

In 2025, 23% of PE firms say that at least three-quarters of the companies in their portfolio utilize AI, up from 8% in 2024. Additionally, 97% say that it is somewhat/extremely attractive if a company they are looking to add already has a successful AI strategy.

This interest makes strategic sense, as research from McKinsey shows that 39% of organizations report a positive earnings impact from deploying AI at the enterprise level.

Prioritizing Customer Outcomes in AI Implementation

Both midsize companies and PE firms cite increasing customer satisfaction as a critical measure of success for the implementation of AI within their business.

Midsize companies and PE firms agree that increasing customer satisfaction is a more important hallmark of successful AI implementation than gaining an advantage over their competitors. Additionally, customer service is the primary way midsize companies are leveraging external firms that utilize AI.

Notably, although the percentage of respondents citing "enhancing customer service" as the top motivating factor for implementing AI remained essentially flat (from 14% in 2024 to 13% in 2025), the percentage that cited it as a top three motivating factor actually increased year over year (from 37% in 2024 to 40% in 2025). This places "enhancing customer service" as the factor with the highest proportion ranked in the top three, ahead of "increasing employee availability" and "reducing risk of human error in financial analysis."

Actions To Consider In 2026

- Explore using agentic AI in your financial processes to improve operational efficiency and workforce productivity.

- Use these survey findings as a launchpad for robust discussions with your broader finance teams around integrating AI more deeply into your financial processes and daily operations.

- For PE firms, add "AI maturity" to your portfolio firm vetting criteria.

- Ensure that your external fraud monitoring partners are employing the latest AI-enabled technology to stay a step ahead of the cybercriminals.

Explanation Of Methodology

For the third consecutive year, Citizens worked with research firm Escalent to survey how financial decision-makers at midsize companies and PE firms are thinking about AI processes and incorporating the technology to enhance efficiency in their financial operations. Participants were screened for their current use of AI or their openness to using AI in the future, and those who were not using it or not interested were excluded.

- All participants worked in industries other than banking at the time of the survey.

- 152 participants were CFOs in mid-size companies with annual revenues between $5 million and $1 billion. However, only data from the 134 companies with annual revenues between $50 million and $1 billion are displayed in this report for trending purposes.

- 153 participants were financial leaders at PE firms with a fund size of less than $1.5 billion, and active with the acquisition and sale of U.S.-based companies with annual revenues between $50 million and $1 billion.

- Internet-based surveys were conducted with Escalent between October 13 and October 23, 2025.

All survey respondents were provided with these definitions of key terms:

- Artificial intelligence: The intelligence of machines and software that can mimic human problem-solving, recognition and decision-making.

- Generative AI: AI technology that uses human prompts to synthesize new images, text and other content by drawing from vast data sets and machine-learning models.

- Financial operations: All aspects of managing the finances of a business/organization, including but not limited to financial analysis, cash flow forecasting, risk management, payments, etc.

- Machine learning: A subset of AI that uses algorithmic learning to automate complex tasks such as custom recommendations, dynamic pricing, etc.

- Robotic process automation: A form of business process automation that allows a virtual bot to perform repetitive/routine tasks.

- Agentic AI: Intelligent systems capable of making complex decisions independently and automating dynamic, multistep processes.

Talk to us about what Citizens is doing in the AI space.

All fields are required unless marked as "Optional".

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

“Citizens” is the marketing name for the business of Citizens Financial Group, Inc. (“CFG”) and its subsidiaries. “Citizens Capital Markets & Advisory” is the marketing name for the investment banking, research, sales, and trading activities of our institutional broker-dealer, Citizens JMP Securities, LLC (“CJMPS”), Member FINRA and SIPC (See FINRA BrokerCheck and SIPC.org). Securities products and services are offered to institutional clients through CJMPS. (CJMPS disclosures and CJMP Form CRS). Banking products and services are offered through Citizens Bank, N.A., Member FDIC. Citizens Valuation Services is a business division of Willamette Management Associates, Inc. (a wholly owned subsidiary of CFG).

Securities and investment products are subject to risk, including principal amount invested and are: NOT FDIC INSURED · NOT BANK GUARANTEED · MAY LOSE VALUE