While 2023 economic uncertainty remains – with inflation still in the spotlight and a hawkish Fed – green shoots of optimism are beginning to appear. What lies ahead for M&A given the current environment? Our Capital Markets & Advisory experts reveal their expectations for the remainder of the year—insights that will enable you to be prepared to seize opportunities and navigate challenges.

August 2023

The Private Equity Perspective: Hopeful Expectations for the Second Half

Written by: Scott Reeds

Head of Corporate Finance & Sponsor Coverage, Citizens

After a prolonged "wait-and-see" deal environment, we believe several factors point to a second half rebound in sponsor-driven M&A activity, especially in the middle-market:

- Improved macroeconomic tone given a growing consensus that the Fed is nearing the end of its rate-increase campaign and that the U.S. economy may experience a "soft landing". While several economic variables are still uncertain, this positive-trending view is improving the climate in the M&A market.

- Progress in the return to normalcy in the broader debt capital markets, where conditions should continue to improve as interest rates peak/decline. Over time, this lower cost of capital and a renewed willingness from banks to take distribution risk will help shake loose more deals from the backlog.

- Increased urgency of private equity community, as there are limits to how long capital can sit idle. Sponsors will be more aggressive in deploying capital to close out existing funds and seek portfolio company realizations to support fundraising.

If middle-market M&A activity comes to fruition as expected in the second half, we should start to see more upmarket processes launch in late ’23 and into early ’24, even though sale processes for lower quality and more cyclical assets may remain on the sidelines until later in ’24. We have already seen growth in the number of process launches relative to the first half of the year, and we expect that momentum to continue after Labor Day.

The shifting macro factors and emerging optimism suggest that companies would do well to begin discussions sooner rather than later. Waiting for more definitive indicators—in the current environment, we are likely to continue to see some mixed signals—may leave prospective buyers and sellers flat-footed.

Increased activity anticipated in 2023 Second Half

Written by: Jason Wallace

Head of M&A Advisory, Citizens

While the overall decline in M&A in 2022 carried over to a slower start in 2023, the backlog of engaged deals that have not yet entered the market is nearing all-time highs in the middle-market – suggesting a tipping point that could contribute to greater deal momentum moving forward.

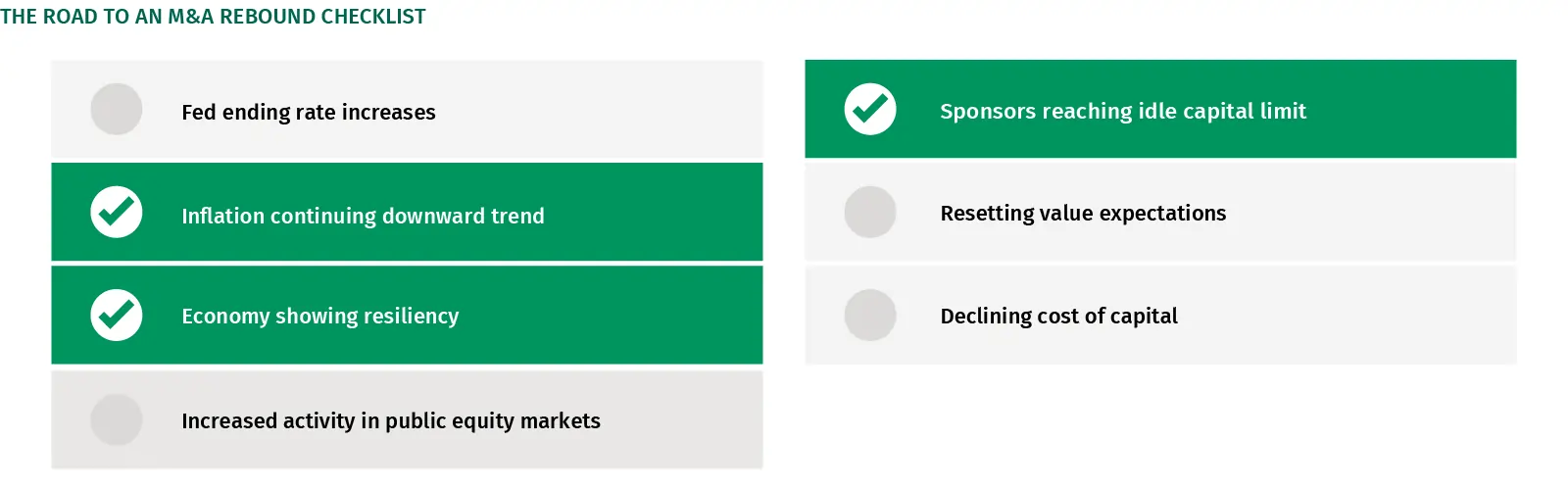

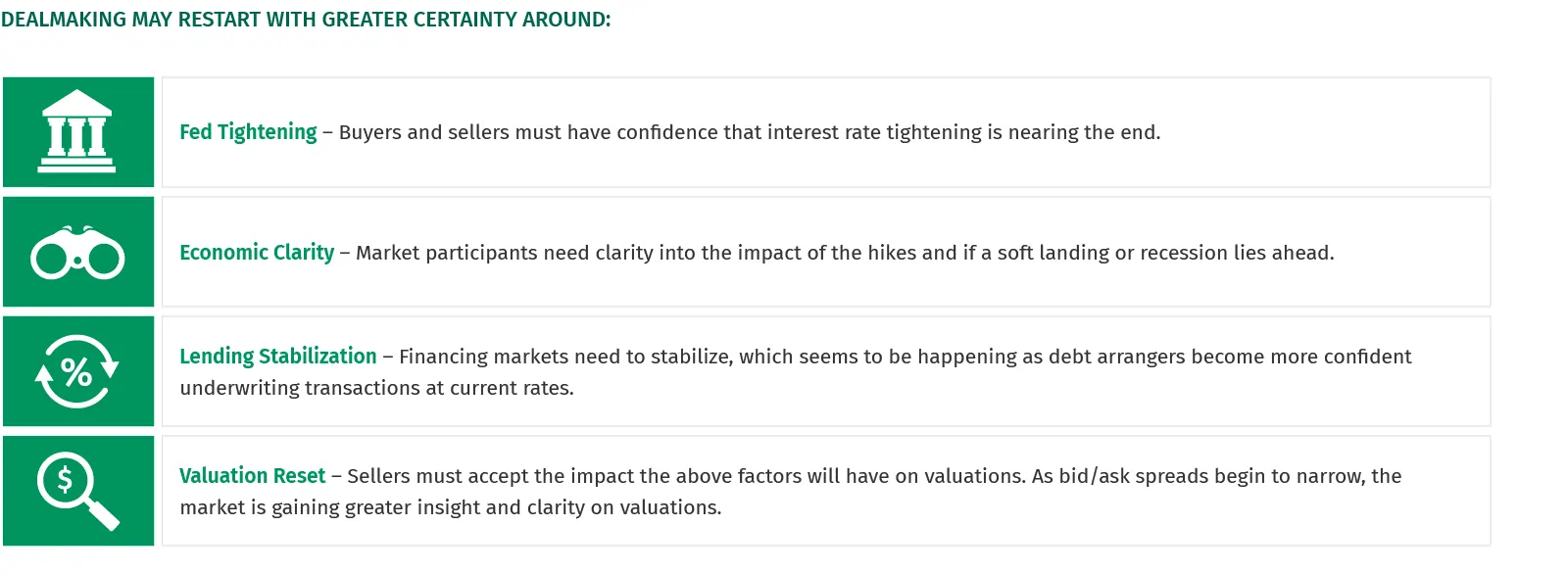

We remain bullish on the M&A outlook for the second half of 2023 and into 2024, with capital from private markets continuing to be plentiful and dry powder from private equity sponsors ready to be deployed for well managed companies. More certainty around monetary policy, the economy, and financing markets should reset valuations expectations and ignite dealmaking.

Importantly, this is not a checklist that requires ALL conditions to be met before moving forward. Our near-term optimism for the second half of the year and strong conviction in long-term secular trends lead us to encourage companies to begin exploring options in such a way that they can accelerate their efforts as uncertainty around the four factors above continues to clear.

Middle-Market M&A Activity and Trends: Green Shoots Show Promise

Written by: Devin Ryan

Director of Financial Technology Research, JMP a Citizens Company

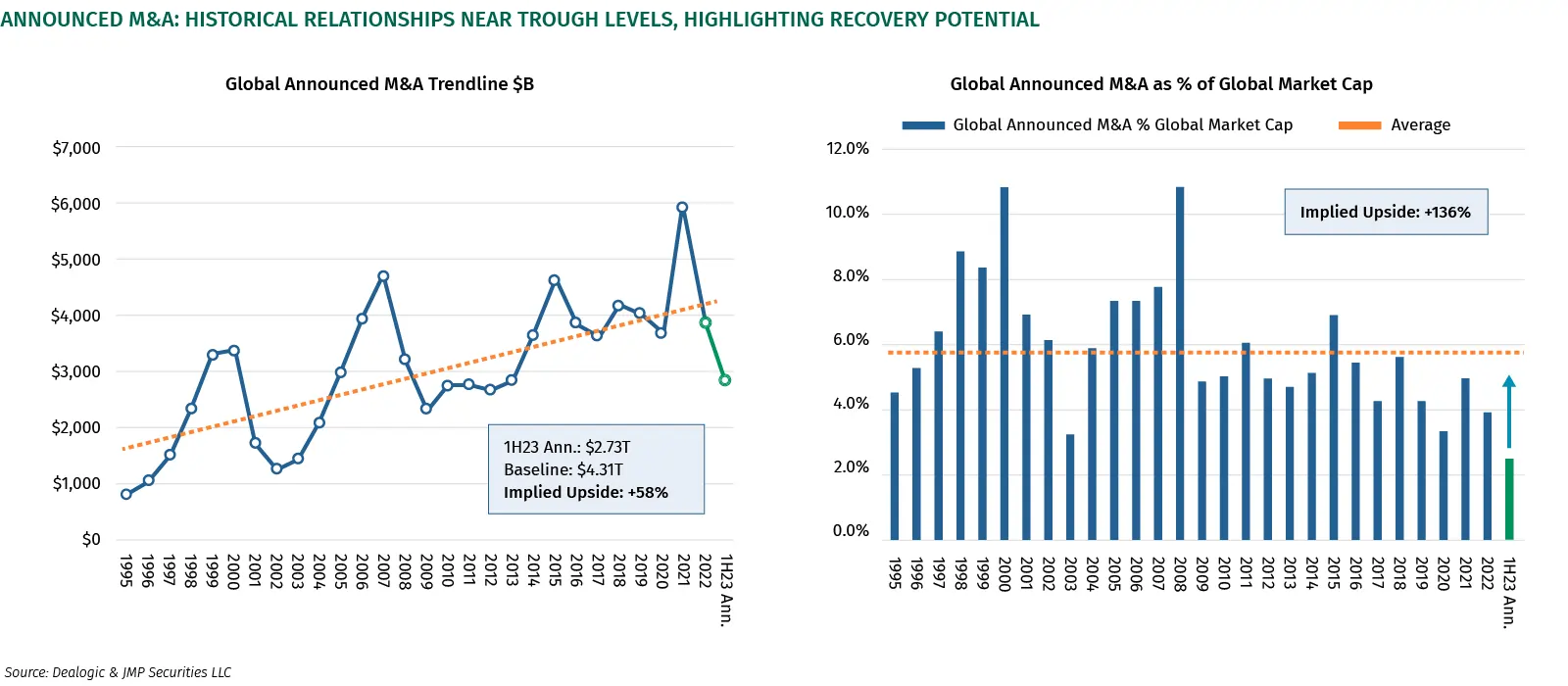

While the M&A market has secular growth underpinnings, it’s also highly cyclical. Macro uncertainty has represented a lingering headwind to M&A activity over the past 18 months, but we are tracking a number of “green shoots” forming, which we assert represent the beginnings of a cyclical upswing. We believe that this augurs an improvement in deal activity in the second half of the year over the low bar in the first, and sets the stage for a broader recovery in 2024. For context: relative to history, announced M&A activity would need to increase over 50% from the 1H23 pace just to get back to a long-term baseline.

As a result, we expect an increasing number of companies, that may have been sitting on the sidelines watching to see if the economic picture gained clarity, will start the ball rolling on discussions and explorations so that they are not left flat-footed when deal activity picks up.

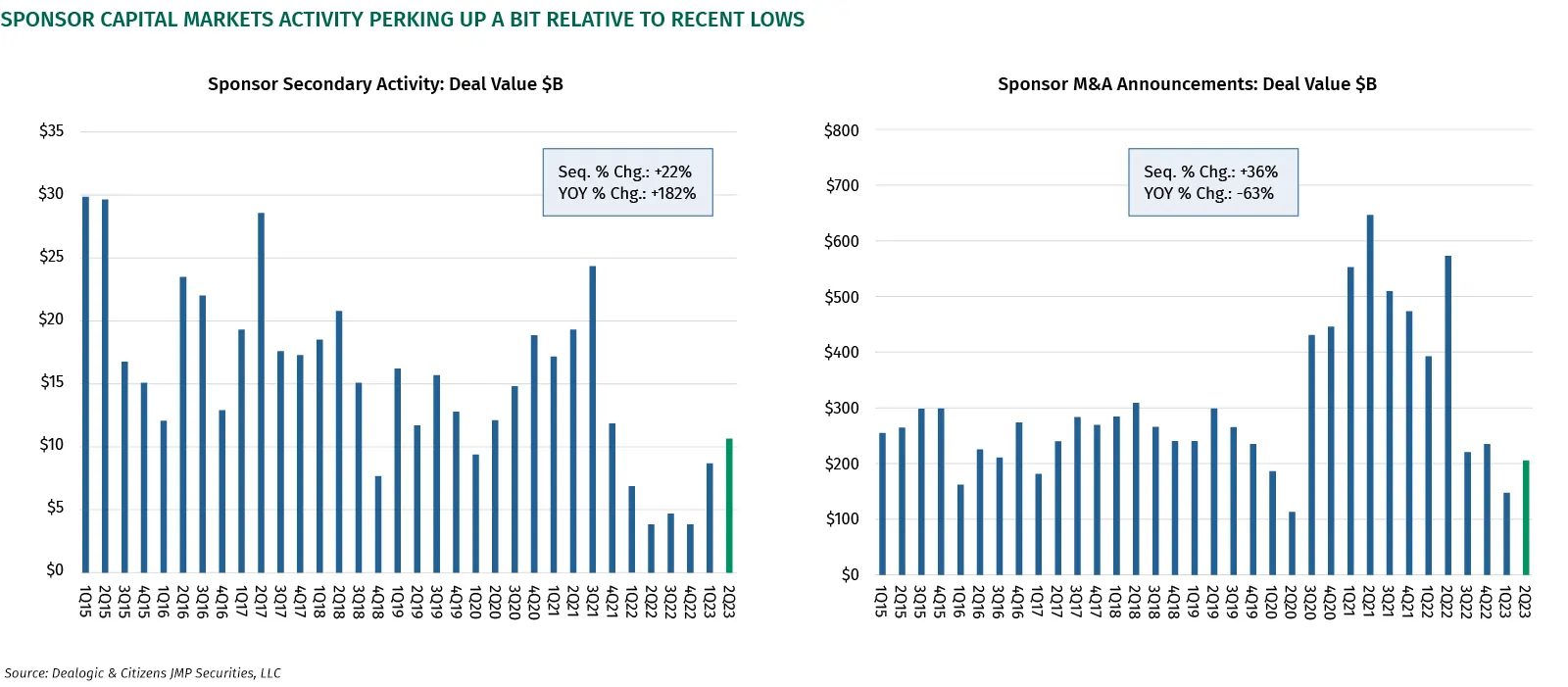

Sponsor-backed secondaries are perking up from recent lows while sponsor-related M&A also experienced modest improvement in the second quarter. These upticks, even if modest, represent to us that the pessimism and caution that marked the first half of the year may be giving way to a more optimistic attitude. With sponsors’ incentives leaning towards deal-making, these positive indicators could be a self-fulfilling prophecy — again suggesting that companies may begin explorations and conversations.

Ready to take the next step? Get in touch with our team.

All fields are required unless marked as "Optional".

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

“Citizens” is the marketing name for the business of Citizens Financial Group, Inc. (“CFG”) and its subsidiaries. “Citizens Capital Markets & Advisory” is the marketing name for the investment banking, research, sales, and trading activities of our institutional broker-dealer, Citizens JMP Securities, LLC (“CJMPS”), Member FINRA and SIPC (See FINRA BrokerCheck and SIPC.org). Securities products and services are offered to institutional clients through CJMPS. (CJMPS disclosures and CJMP Form CRS). Banking products and services are offered through Citizens Bank, N.A., Member FDIC. Citizens Valuation Services is a business division of Willamette Management Associates, Inc. (a wholly owned subsidiary of CFG).

Securities and investment products are subject to risk, including principal amount invested and are: NOT FDIC INSURED · NOT BANK GUARANTEED · MAY LOSE VALUE