Payables and Receivables Innovation

By Matt Richardson | Head of Treasury Product Solutions, Citizens Commercial Banking

Meeting customers where they are

One insight that has materialized, particularly as part of the pandemic response, is that customer needs are more important than ever. This has been invaluable when trying to evaluate new technologies and determine how to integrate them with existing systems and infrastructures.

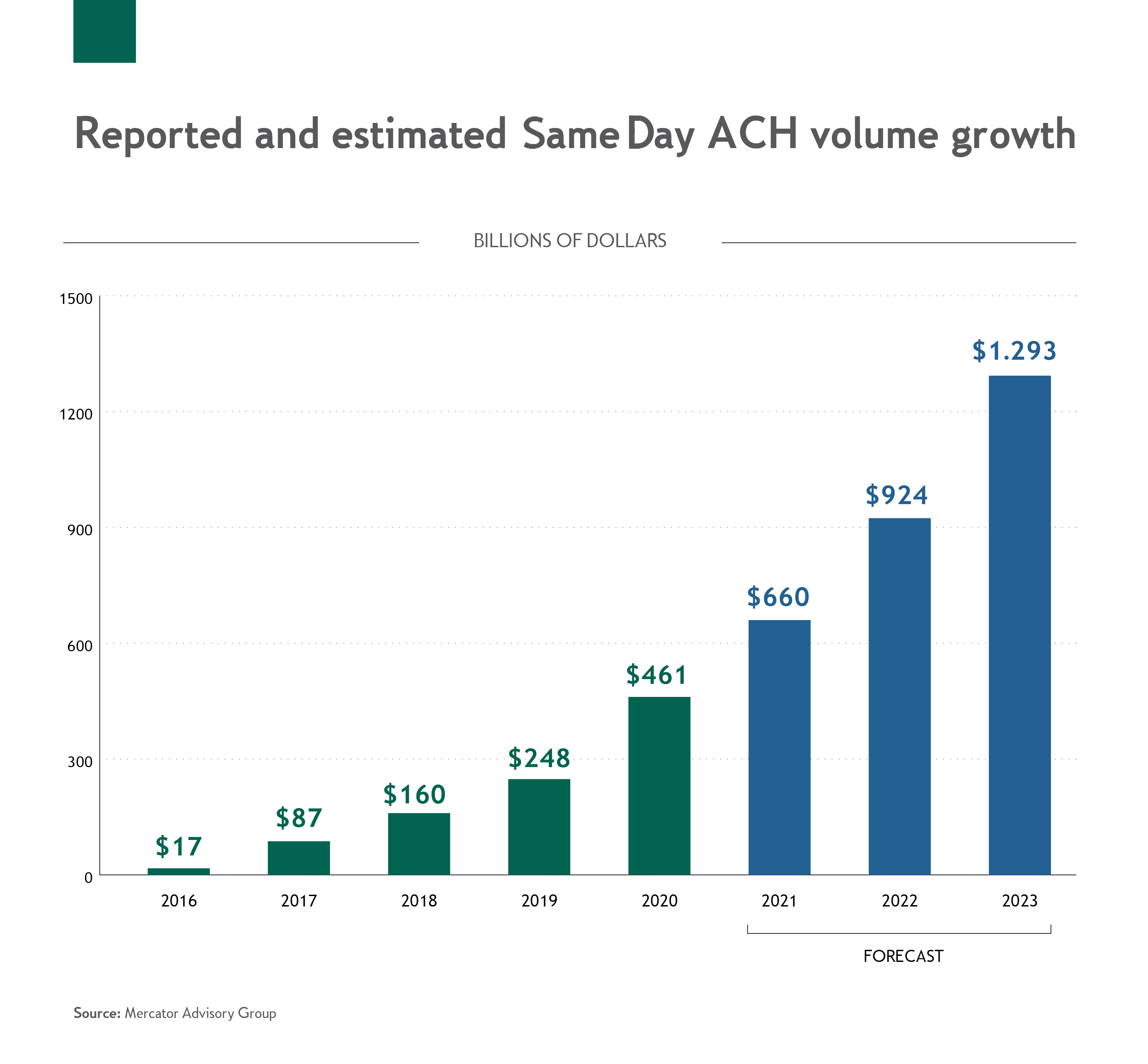

We’ve seen many companies embrace faster and easier payments systems. Traditional options such as checks, automated clearing house (ACH) and wire are regularly being uprooted by high-speed digital alternatives including real-time payments, virtual card and even Same Day ACH. The modern options are simply more efficient, more transparent and incredibly precise — and the growth has been impressive. Same Day ACH, for example, has jumped in volume from $17 million in 2016 to $461 million in 2020, according to Mercator Advisory Group.

The corporate shift has in part been motivated by the consumerization of the payment experience that has popularized on-demand and real-time innovations, such as contactless payments, digital wallets and on-demand payment tools.

The COVID-19 pandemic worked to further accelerate this move toward digitization and expose the expendability of paper transactions. Businesses realized that they no longer needed to handle physical items in physical locations and quickly pivoted as they discovered accessible and easy to use digital options.

Those who have made the shift to digital transactions, especially the early adopters, now expect the companies they do business with to be up to speed with on-demand and real-time services. It’s become very important to meet trading partners or customers on the right platform with the right tools.

Newer, faster and even more precise payments and processes

Looking forward, faster and more accurate transactions and payments schemes will continue to gain traction and see widespread adoption. With change happening quickly and plenty of product fragmentation, it will be difficult to know what’s important and where best to invest attention and resources. Corporate treasurers will need to focus on prioritizing operational and strategic value, as well as on determining what will best align with their internal competencies and IT capacity.

Connectivity and automation will drive the digital transformation

Advanced connectivity is increasing the speed, availability and transparency of payments, making it easier and more cost-effective to manage everything from accounts payable (AP) and accounts receivable (AR) to cash flow and reporting.

One territory that has already taken off and made an impact is API technology, which enables companies to integrate banking and payment services directly into their own enterprise resource planning and treasury management systems. There’s a lot of potential for innovation and just a few of the benefits for treasurers include cutting-edge insights and analytics, more efficient payments and better working capital management.

Despite slow initial uptake, more corporates are also set to embrace the powerful connectivity and 24/7/365 flexibility of real-time payment networks like RTP®. There is work to be done, but it will be a game-changer in streamlining billing and payment procedures, improving transaction communication, decreasing reconciliation times and further reducing reliance on paper. While the RTP® now reaches more than half of transaction accounts in the U.S., the Federal Reserve Banks are developing a similar end-to-end instant payments platform, the FedNow Service. This is set to launch by 2023 and will extend access to real-time payments to more financial institutions and customers nation-wide.

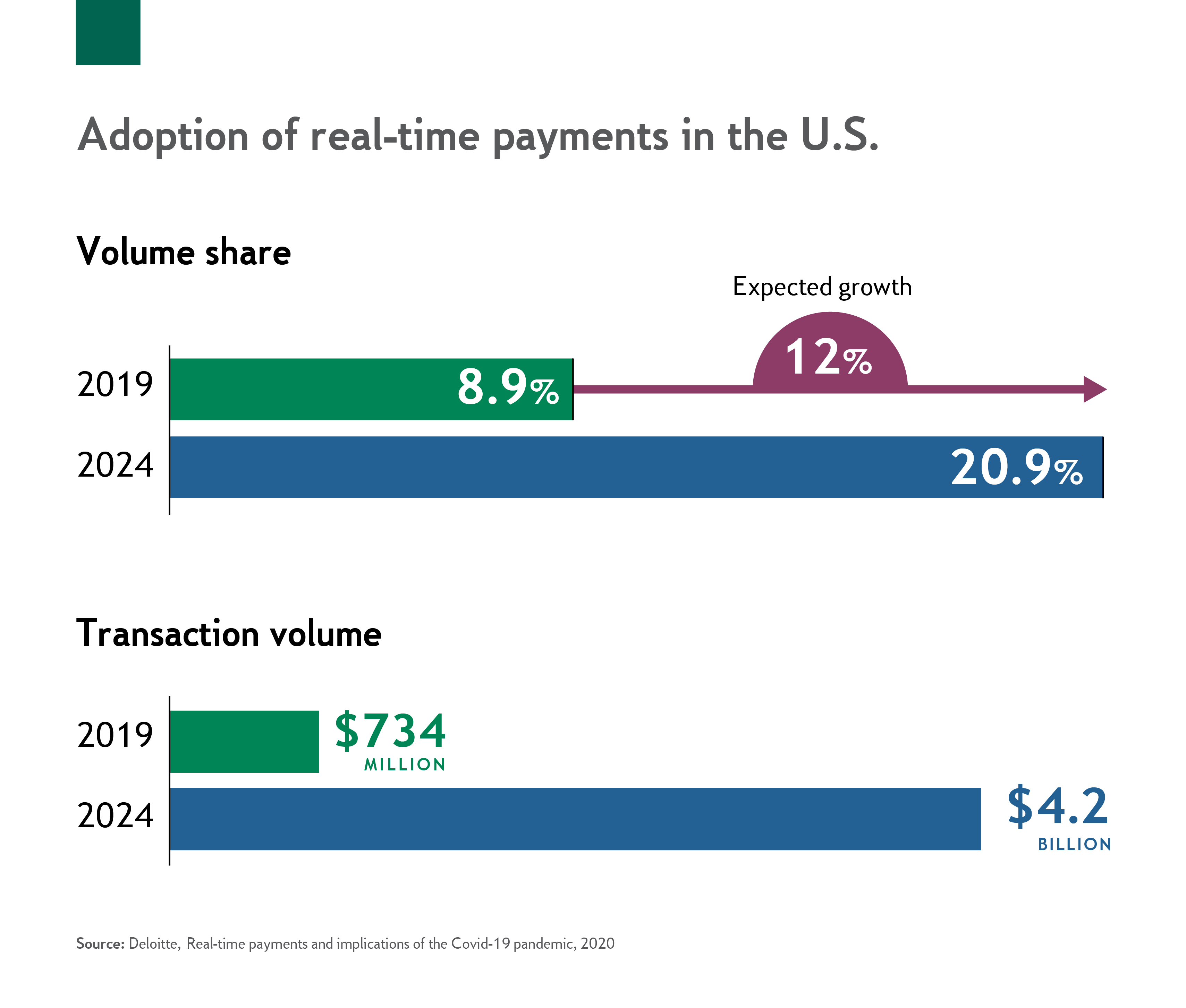

By 2024, Deloitte expects real-time payments to make up a 20.9% share of volume in the payments market with projected transaction volume of $4.2 billion.

Another key trend in connectivity will likely be point-to-point encryption solutions (P2PE), a new standard for encrypting account and transaction information. It’s an important layer of added security that will make it faster and simpler to conduct transactions and further open doors toward tokenization, a process where card or account numbers can be encrypted and passed through the internet without revealing actual bank details.

Finally, there’s also a push towards the corporate application of the Internet of Things (IoT), which promises to disrupt and better connect business-to-business trade, especially in areas like manufacturing.

Automation

In terms of automation, machine learning (ML) and artificial intelligence (AI) will have a critical role in realigning treasury operations and streamlining AP and AR processes. Intelligence-driven automation is being deployed to reduce manual processes, improve payment accuracy, optimize data exchange and consolidate invoicing and receivables reconciliation. It’s helping create significant operational efficiencies and organizational value. The dominant force in this area will be cloud-based, intelligent payables and receivables platforms like Citizens’ integrated payables solution powered by Paymode-X.

Alongside automation, data and analytics will continue to be a big part of how treasury departments will define their AP and AR functions in the coming years. With greater connectivity and more information being shared about customers and transactions, there will be more potential to generate valuable business intelligence. Organizations will gain access to powerful insights to advise with, improve services, reduce costs and pursue new opportunities.

Relatedly, payment messaging will be an essential area to keep track of as new digital payments options are becoming increasingly sophisticated and data-intensive. Standardized messaging between financial institutions, specifically ISO 20022, is a growing global initiative and corporates need to be ready to migrate their systems to be compliant.

The bottom line is that amidst this rapid pace of innovation, treasurers will be at a disadvantage if they aren’t staying abreast with the latest developments and readying their systems for what’s next.

Growth in payables and receivables will depend on technology readiness

With innovation happening at full speed, treasurers looking to bolster the efficiency and effectiveness of their payables and receivables will need to zero in on strategic decision-making and organizational value. Looking at future growth and being ready to take advantage of tomorrow’s opportunities, our high-level recommendations are to keep a close watch on the technology in this space and ensure your internal capabilities are primed and ready for what’s next.

Key Takeaways

- Reduce paper

The tools and market demand are there and there’s never been more evidence for how easy it is to make the digital shift — or how important it is for improving the bottom line. - Keep infrastructure up to date

If you want to leverage the functionality and power of new technologies, making major upgrades late in the game can be a huge challenge. - Explore new payment types and leverage online solutions

Do the research, but don’t hesitate to try something new. End-to-end platforms and services are a convenient, low-risk entry point to the world of faster payments and better customer experiences. - Embrace automation

Leverage AI and ML to streamline processes, consolidate data and eliminate manual tasks. The operational efficiencies, cost savings and strategic value will have a powerful impact on the bottom line. - Work proactively with your partners

It’s critical to pay close attention to what your partners are doing and to make sure your customers’ technology needs are being met.

Related Reading

What Treasurers Need to Know about Cyber Risk

As businesses achieve greater digitization in areas like payables, there may be more access points for cyber criminals to exploit.

The Basics of Ransomware Attacks

Discover how to detect, prevent and mitigate the risk of a ransomware attack.

Decreasing Greenhouse Gas Emissions

Why reducing the climate impact of your business could be easier than you might expect.

Ready to take the next step? Get in touch with our team.

All fields are required unless marked as "Optional".

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

“Citizens” is the marketing name for the business of Citizens Financial Group, Inc. (“CFG”) and its subsidiaries. “Citizens Capital Markets & Advisory” is the marketing name for the investment banking, research, sales, and trading activities of our institutional broker-dealer, Citizens JMP Securities, LLC (“CJMPS”), Member FINRA and SIPC (See FINRA BrokerCheck and SIPC.org). Securities products and services are offered to institutional clients through CJMPS. (CJMPS disclosures and CJMP Form CRS). Banking products and services are offered through Citizens Bank, N.A., Member FDIC. Citizens Valuation Services is a business division of Willamette Management Associates, Inc. (a wholly owned subsidiary of CFG).

Securities and investment products are subject to risk, including principal amount invested and are: NOT FDIC INSURED · NOT BANK GUARANTEED · MAY LOSE VALUE