2023 M&A Outlook: The Private Equity Perspective

By Scott C. Reeds, Head of Financial Sponsors Group & Corporate Finance, Citizens Capital Markets

- Nearly four in 10 private equity (PE) firms surveyed expect a strong deal environment, a significantly more bullish outlook than mid-market companies

- PE firms indicate that one reason for strength is a healthy deal flow

- Valuation outlooks are moderated from last year, but remain upbeat

- PE firms, like mid-market companies, believe the current mergers & acquisitions (M&A) environment favors sellers, on balance

- Technology, Media, and Telecommunications (TMT) is where PE firms see the most M&A opportunity

The outlook of middle-market business leaders is usually a good barometer for trends and opportunities in M&A – but PE firms have a unique vantage point as well. In the 12th annual M&A Outlook survey, both groups shared their expectations for 2023. Here, we focus on the responses of 125 PE firms that specialize in the middle-market.

PE firms have a keen sense of the M&A deal environment. They often see both sides of transactions – being buyers and sellers themselves – and are closely connected to bankers, investors, consultants, and others with influence in the process. Key findings from the PE perspective include:

Read the full 2023 M&A Outlook Report here.

1 – PE firms see a stronger M&A environment than companies do

38% of PE firms say the projected 2023 M&A environment will be strong, compared with just 25% of middle-market companies.

PE firms have a compelling track record when it comes to characterizing the M&A environment. They were significantly more bullish than mid-market companies in 2021 and 2022 as well – a time when the post-pandemic M&A boom drove record-setting activity before the drop-off in the second half of 2022.

Notably, PE firms are optimistic even in the face of macroeconomic uncertainties. While most firms said it would be more than a year before volatility normalizes on metrics like inflation, commodity prices, and labor-market challenges, many still foresee strong activity in 2023.

As expected, PE firms’ views vary significantly by sector. Firms that invest in Business Services and TMT sectors were most likely to say the current M&A environment was strong. On the flipside, firms investing in Healthcare and Transportation and Logistics had a significantly weaker outlook.

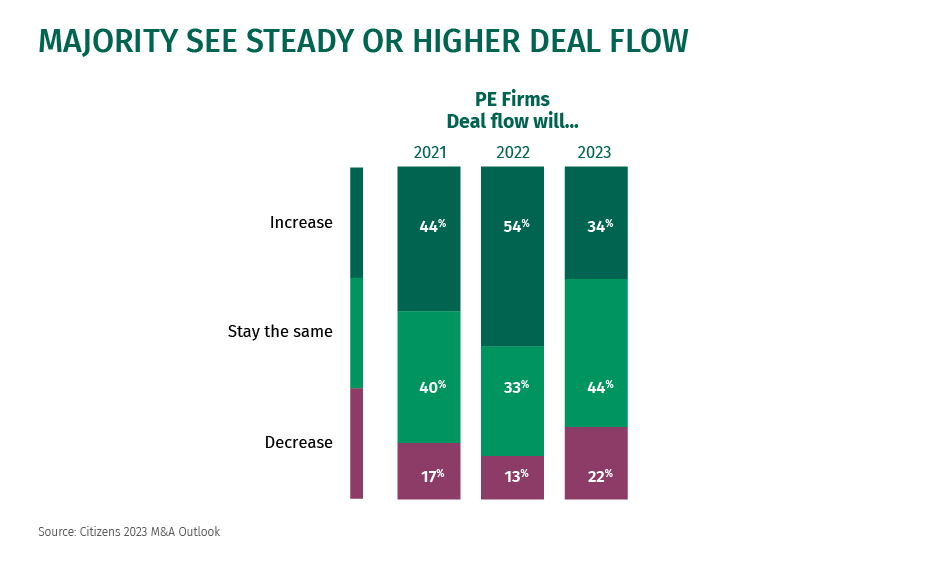

2 – PE firms expect moderated but healthy deal flow

PE firms offer more muted 2023 expectations for deal flow, compared to the year before – yet their views remain generally positive. The largest number of PE decision-makers, 44%, expect deal flow to be consistent with 2022, a year when deals slowed from record levels but returned to pre-pandemic trends, while another 34% of PE firms expect deal flow to increase in 2023.

PE firms also indicated that they see the market returning to more typical M&A conditions, as opposed to the swings of the pandemic era. Among firms that expect higher deal flow, 52% say the uptick is due to “an increase in PE-backed assets coming to market” while 36% say deal flow will be boosted by “an increase in private companies seeking a private equity partner.”

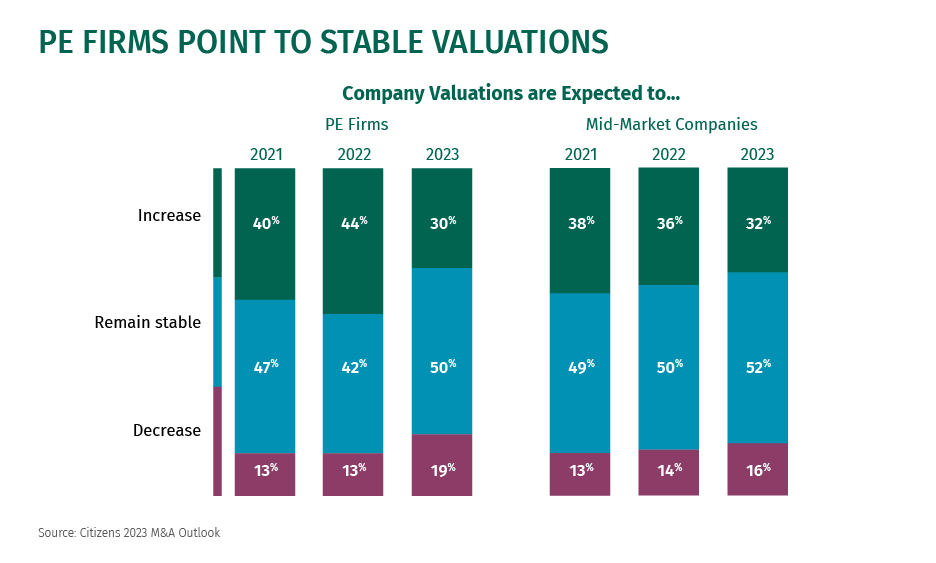

3 – A dip in PE views on valuations

In 2022, PE firms were more bullish about valuations, but that has moderated. For 2023, 30% of PE firms believe company valuations will increase, in-line with the 32% of company respondents who indicated similar expectations. Both PE firms (50%) and companies (52%) said stable valuations would be the most likely outcome in 2023.

Overall, opportunities related to valuations were less of a focus in this year’s survey. For instance, in 2022 there was a spike in sellers looking to disburse the entire company versus divesting only part – presumably driven by opportune market valuations. The outlook for 2023 indicates a more typical mix between companies looking to undertake partial business carve-outs versus those selling the full entity. There was also a downtick among survey respondents mentioning they are considering a sale “to take advantage of current valuations.”

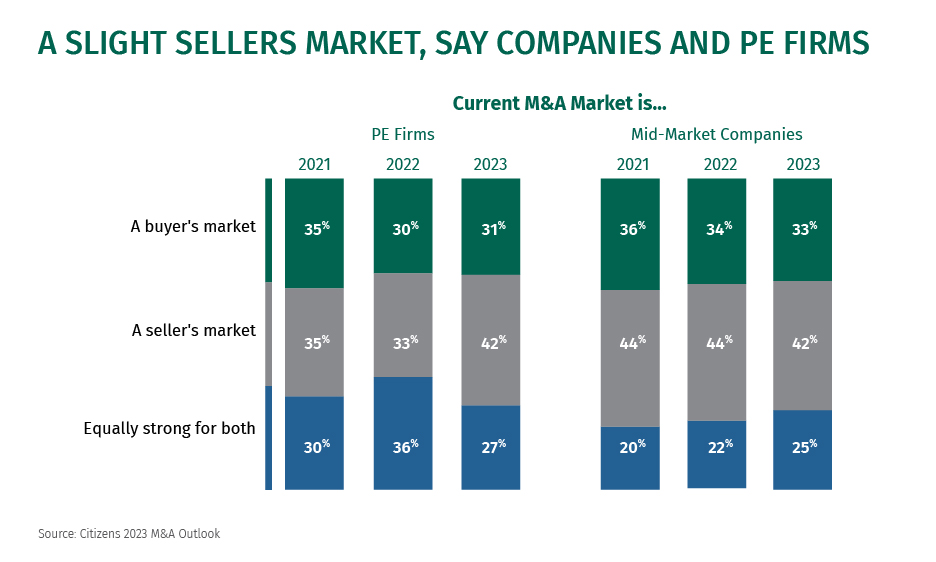

4 – Companies and PE firms share similar views of buyer/seller dynamics

PE firms weighed in on the balance between buyers and sellers, with more respondents saying 2023 market conditions will favor sellers. Middle-market companies have carried this same view for the last three years.

Dynamics in the financing markets – which posed challenges in 2022, especially to mega-deal buyers – may have led to a more pronounced shift to sellers. According to Fitch Ratings, new issuance in the leveraged loan market was down 46% between the second and third quarters of 2022 as syndication backlogs mounted, hampering the pipeline of new financing.

The sense that 2023 will tip in favor of sellers could also reflect the imbalance between the number of buyers and sellers in the market. For 2023, 53% of middle-market companies said they are potential buyers – either currently involved in buying activity or open to it this year, which was an increase from 2022. Meanwhile, 40% of middle-market companies say they are potential sellers – which remained consistent with prior year. With more buyers and the same number of sellers in the M&A space, advantage could tip in favor of sellers for the year ahead.

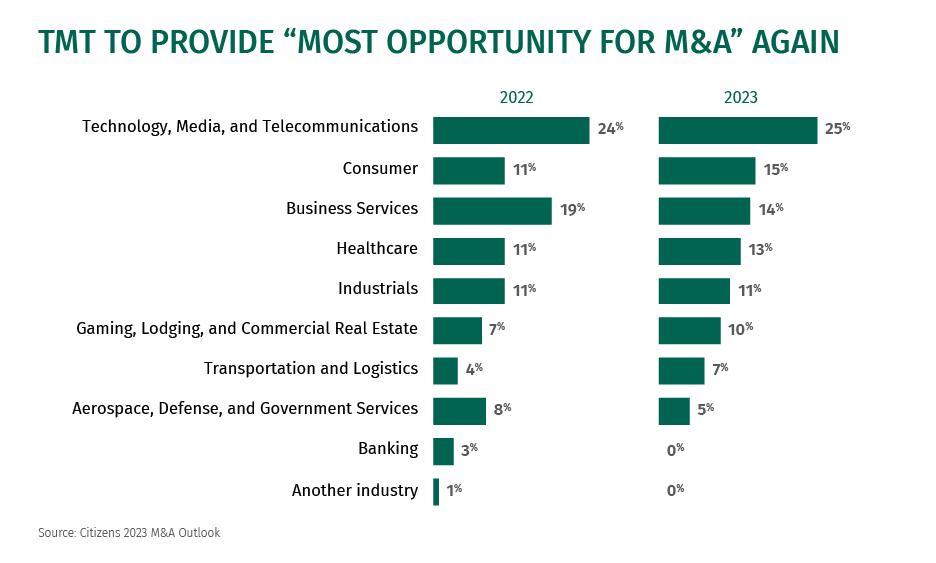

5 – PE firms see the greatest opportunity in TMT

As in 2022, PE firms believe TMT offers the best opportunity for M&A activity in 2023. The sector could see significant retrenching amid the disruption of the last three years. These disruptions included soaring demand for technology during the early pandemic, followed by a wave of consolidation and restructurings, then privatizations and initial public offerings. As the post-pandemic era takes shape, the tech sector remains ripe for change – with continued opportunity for both buyers and sellers.

Predicting a positive year ahead for M&A

Responses from PE firms in the 2023 M&A Outlook reflect a moderated but positive view of the market. After living through peak valuations and deal flow in 2021, followed by the headwinds of inflation, climbing interest rates, falling public equities and clogged credit flow in the second half of 2022, PE firms painted a more normalized picture for 2023.

After the peaks of 2021 and the headwinds of 2022, PE firms painted a picture of a productive 2023, on balance.

However, PE firms acknowledge potential stumbling blocks. Interest rates continue to be an area of concern – though the view of rates in 2023 is far from uniform. Some PE firms said rising rates made them less likely to pursue deals, while others said they expect 2023 rates to be supportive of activity.

Overall, most PE firms see a favorable deal environment rooted in steady valuations and solid deal flow.

Key Takeaways

In 2023, PE firms must manage a dynamic economic environment and consider that:

- Deal activity could carry-on even as interest rates and macroeconomic issues persist. While interest rates climbed at a record pace in 2022, they remain at historically low levels.

- Sellers could have an advantage. Though valuations are not at 2021 peaks, PE firms and companies both see slight favor to sellers in the market.

- Be prepared for a competitive deal process. PE firms saw TMT as the top opportunity, but nearly every sector earned some “top opportunity” votes. Alongside steady valuation expectations, the deal process could be highly competitive.

Related Reading

What Treasurers Need to Know about Cyber Risk

As businesses achieve greater digitization in areas like payables, there may be more access points for cyber criminals to exploit.

The Basics of Ransomware Attacks

Discover how to detect, prevent and mitigate the risk of a ransomware attack.

Decreasing Greenhouse Gas Emissions

Why reducing the climate impact of your business could be easier than you might expect.

Ready to take the next step? Get in touch with our team.

All fields are required unless marked as "Optional".

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

“Citizens” is the marketing name for the business of Citizens Financial Group, Inc. (“CFG”) and its subsidiaries. “Citizens Capital Markets & Advisory” is the marketing name for the investment banking, research, sales, and trading activities of our institutional broker-dealer, Citizens JMP Securities, LLC (“CJMPS”), Member FINRA and SIPC (See FINRA BrokerCheck and SIPC.org). Securities products and services are offered to institutional clients through CJMPS. (CJMPS disclosures and CJMP Form CRS). Banking products and services are offered through Citizens Bank, N.A., Member FDIC. Citizens Valuation Services is a business division of Willamette Management Associates, Inc. (a wholly owned subsidiary of CFG).

Securities and investment products are subject to risk, including principal amount invested and are: NOT FDIC INSURED · NOT BANK GUARANTEED · MAY LOSE VALUE