2026 AI trends in financial management

The rise of Agentic AI accelerates adoption and investment momentum.

Business leaders plan for growth amid economic uncertainty

Two recent Citizens surveys reveal how businesses are tackling challenges like inflation and talent acquisition while prioritizing workforce development and sustainable practices.

Supply chain finance benefits both buyers and sellers

Corporate supply chains exist in a global landscape that has changed radically over the past five years. Discover how, given the right circumstances, supply chain finance can help buyers and sellers collaboratively adapt to this new reality.

2025 AI Trends in Financial Management

Discover how more and more mid-size and private equity CFOs are using AI for payments and fraud mitigation across their business.

What should business leaders know about Private Credit?

Private Credit is now one of the three leading financing options for corporate acquisition and growth. Learn more about what to consider when evaluating financing options.

The benefits and challenges of ESOPs

Employee Stock Ownership Plans (ESOPs) are picking up steam with their ability to benefit both owners and employees. Discover how they work and the key factors to keep in mind when considering adoption.

Cross-currency swaps

With global financial markets in flux and interest rates beginning to diverge, companies are increasingly relying on cross-currency swaps to manage financial risks and stabilize their international operations.

Ascend Case Study

When Ascend Performance Materials undertook its largest ever facility update in 2021, it was able to cut greenhouse gas (GHG) emissions by 40%. Learn how they did it, with Citizens’ help.

Fundamental concepts in foreign currency risk management

In this white paper, learn how foreign currency hedging programs may help businesses operating internationally reduce risk and limit the impact of currency volatility on future financial performance.

The green shift: ESG's effect on equity valuations

As investors become more social-conscious, ESG factors are reshaping equity valuations. Explore the latest trends for how these factors can affect a company's valuation.

AI Trends in Financial Management

Data is driving more and more organizations' financial decisions and operations. Discover how mid-size and private equity CFOs are thinking about artificial intelligence (AI) and how they're using it in their business.

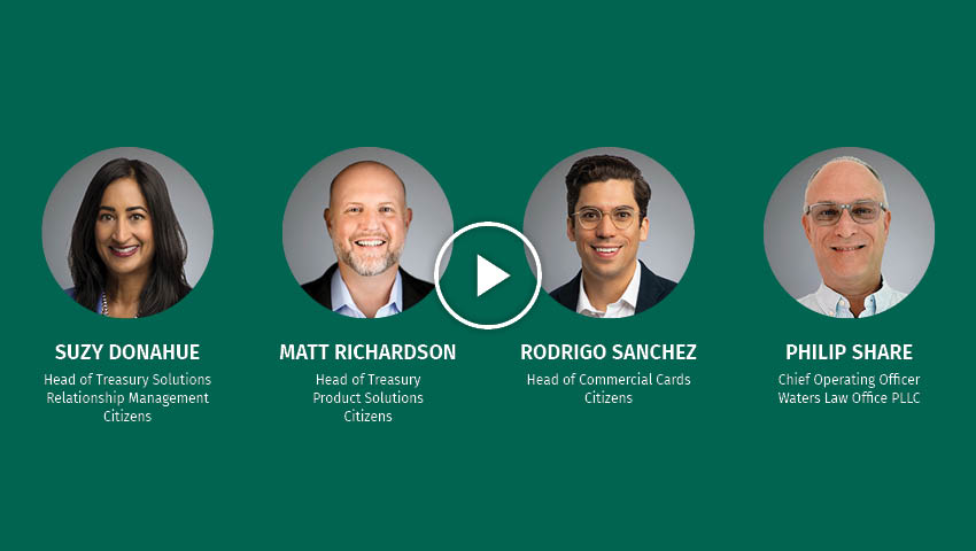

Webinar replay - AI Trends in Financial Management

Hear financial experts from Citizens and Omega Venture Partners discuss how CFOs of mid-sized companies and leaders at private equity firms are assessing and integrating artificial intelligence (AI) into business processes.

Aligning capital with strategic plans in a mixed market

A mindset of financial flexibility can help companies align its capital with strategic plans in murky market conditions. Find out the mix of priorities companies are balancing and strategies to consider to find the right balance between investing and deleveraging.

How to manage the dual risks facing international trade today

Global trade volumes may have recovered from the pandemic, but challenges remain for U.S. companies buying and selling internationally.

Small restaurant franchisees are at a crossroads

Franchise owners are feeling the pressure to consolidate to get the scale necessary to manage challenges and compete effectively.

Financing for growth and efficiency

Successful capital planning starts with setting your business strategy and then pursuing the right financing to drive those objectives.

Life Cycle Financing with Asset-Based Lending

Discover how asset-based lending can help you manage the ups and downs of the economic cycle.

Family-owned business succession planning

By taking steps to evaluate your business and prepare it for a transition, you can maximize value and bolster the company's position.

City of Atlanta aligns process with purpose

How did the City of Atlanta align purpose with process to launch it's first Social Bond in 2022? Through new financial tools that enabled them to do more with their proceeds.

Twin Rivers Paper study

Discover how Twin Rivers Paper Company was able to restore flexibility to it's capital structure, with tailored advice from Citizens.

Lacerta Group study

Learn how Lacerta Group was able to navigate the transition of family founders during the pandemic, resulting in a private sale to a strategic buyer.

Ready to take the next step? Get in touch with our team.

All fields are required unless marked as "Optional".

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

“Citizens” is the marketing name for the business of Citizens Financial Group, Inc. (“CFG”) and its subsidiaries. “Citizens Capital Markets & Advisory” is the marketing name for the investment banking, research, sales, and trading activities of our institutional broker-dealer, Citizens JMP Securities, LLC (“CJMPS”), Member FINRA and SIPC (See FINRA BrokerCheck and SIPC.org). Securities products and services are offered to institutional clients through CJMPS. (CJMPS disclosures and CJMP Form CRS). Banking products and services are offered through Citizens Bank, N.A., Member FDIC. Citizens Valuation Services is a business division of Willamette Management Associates, Inc. (a wholly owned subsidiary of CFG).

Securities and investment products are subject to risk, including principal amount invested and are: NOT FDIC INSURED · NOT BANK GUARANTEED · MAY LOSE VALUE