5 Home improvement ideas to add value and maximize space without buying a new home

By Citizens Staff

Key takeaways

- In a competitive real estate market, renovating your current home is an alternative to moving.

- Many home improvement projects can add value to your home while providing longer-term livability.

- Financing options like HELOCs can offer lower rates and long-term repayment periods to help you cover the cost of renovations.

When you first move into a home, it can seem like more space than you know what to do with. But households have a way of spreading to fill every room. At some point, you may look around and wonder if it's time to get a bigger place.

Before you commit to moving, though, consider that adding square footage to your existing home might be less expensive and more convenient. Rather than uprooting your life for an expensive relocation, building an addition or expanding your kitchen may get you closer to your dream living space and increase the value of your house for when you're ready to sell.

Reasons to renovate instead of buying

Fluctuating real estate markets can upend even the best plans. There are many valid reasons to consider renovating your home instead of buying something new, including the following:

- You like your house. You like your neighbors, the nearby amenities and the proximity to your job.

- Real estate prices are skyrocketing. You may need to wait out a hot market.

- Moving can involve high short-term costs. The expenses and hassle of relocating can make renovations seem more appealing.

- You want to boost your home's value. Renovations can increase your future sales price while adding updated style and comfort to your home.

Consider these 5 home improvement ideas

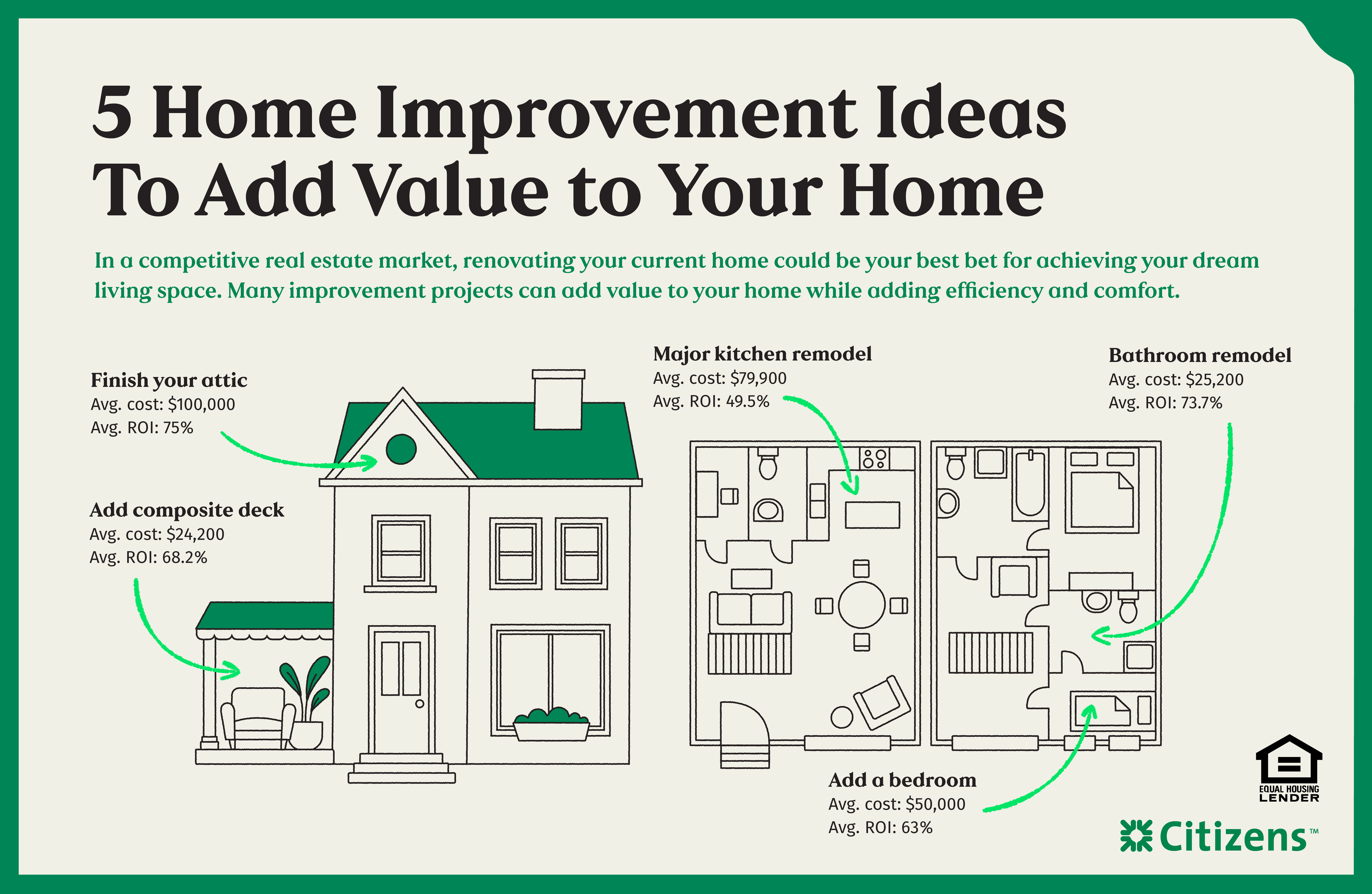

The most desirable cities and towns also generate some of the most competitive real estate markets. If the numbers associated with moving aren't adding up for you, renovating your current home may present a better option. Here are some home improvement ideas to consider:

Update your kitchen

If you imagine baking, cooking and hosting dinners in a stylish new space, you're not alone. Updated kitchens rank high with homebuyers.

Changes to your kitchen can range from small touchups to a full overhaul. Minor renovations often include replacing cabinet fronts and hardware, updating to energy-efficient appliances, installing resilient flooring and repainting walls. Simple updates like this may cost about $27,500 using national averages, but they can have a 96.1% return on investment (ROI) according to Remodeling magazine's 2024 Cost vs. Value Report.

According to the National Kitchen and Bath Association, adding an island is considered a top trend in kitchens. If you go this route and do other major renovations such as upgrading to custom cabinets and lighting, the cost could bump up to almost $80,000 and have only a 49.5% ROI.

Increase your square footage with an addition

With an average cost of around $50,000, according to Home Advisor, building an addition is a complex project that requires upfront planning and budgeting. But if you're having trouble finding a larger home that meets your needs and fits your budget, you may consider adding square footage to your living space.

Work with home remodeling contractors to come up with a design. Gather several estimates to compare costs before making a final decision. Also consider that how much ROI you might get will depend on the type of addition: A second story or an additional bedroom/bathroom suite could get you 65% and 63% ROI respectively, but a sunroom has an ROI of just 49%.

Revive your bathroom and make it accessible

When it comes to recouping the costs of renovations in the future value of your home, a bathroom remodel can offer a good ROI. A typical midrange remodel might involve adding a porcelain tub, an upgraded vanity and sink and ceramic flooring. The average cost according to Remodeling’s report, is around $25,200 with an ROI of 73.7%.

Another alternative to consider is incorporating universal design with your bathroom remodel. This involves making the space fully accessible for wheelchair users, including a flat-entry walk-in shower and weight-supporting bars installed at strategic points on the walls. These features can take the cost up to $40,700 with an ROI of 46%.

Finish your basement or attic

Rather than building onto your home, you might consider finishing or repurposing existing space. Basement and attic conversions are often priced by square foot, so you can look at the relative size of each space in your home to determine which option works better for your budget.

According to figures by the National Association of Realtors Research Group, both options can give you a great ROI, but attic remodels tend to be more expensive than basements because they usually require extensive changes such as heating, plumbing, drywall and roof expansion to make the space livable. The average cost to convert an attic is $100,000 with a 75% ROI. For a basement, the average cost is $57,500 with an 86% ROI.

Add an outdoor living space

Outdoor living spaces can range from a simple deck with a price tag under $20,000 (or less if you tackle it yourself) to lavish patios with luxury appliances and design features costing upward of $30,000.

Remodeling's Cost vs. Value Report puts a wood deck addition at a cost of around $17,600 and an 82.9% ROI. Going with a composite deck material will cost about $6,000 more and only net an ROI of 68.1%, but it does require less maintenance than wood. If you go for a patio renovation, Forbes reports you could see an ROI from 67% to 71% depending on whether you choose features like a simple gas-powered fire pit surrounded by pavers or a full outdoor kitchen and grill station.

Ways to finance home upgrades

Before you're ready to renovate, establish a budget and decide how you'll pay for your project. Depending on the size and total price of your remodel, you have a variety of financing options:

- Withdrawing a portion of your savings

- Cashing in an investment

- Cash-out refinance loan

- Using credit cards to take advantage of rewards or loyalty programs

Consider getting a HELOC

According to Yahoo Finance, 38% of homeowners choose a home equity line of credit (HELOC) to help pay for home renovations. A HELOC's open line of credit gives you access to funds similar to a credit card.

HELOCs tend to offer lower interest rates than credit cards or personal loans, and they're secured against the equity in your home. Interest rates for HELOCs are typically variable, which means payments can fluctuate as rates rise and fall. Something to keep in mind is that interest paid on HELOC funds used to improve your home may be tax-deductible.

You don't need to move to achieve your dream home

If mortgage rates or a hot real estate market make you think twice about moving, home renovations may be a better solution. Done right, remodeling or expanding your home can add value and improve long-term livability.

Are you thinking about a HELOC for your next home improvement project? Get started with Citizens FastLine®, one of the easiest ways to get a home equity line of credit.

Related topics

8 facts to know before getting a HELOC

Think you know about HELOCs? You may not have all the facts straight. Learn what's important to look for when picking a lender.

Use your home equity to finance senior living renovations

Senior living remodeling could be ideal for you or your loved one to increase your home’s comfortability and functionality as you age.

9 ideas for eco-friendly home improvements using a HELOC

Upgrading to an eco-friendly home can offer substantial savings and a positive environmental impact.

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

Home Equity Lines of Credit are offered and originated by Citizens Bank, N.A.

Disclaimer: The information contained herein is for informational purposes only as a service to the public, and is not legal advice or a substitute for legal counsel, nor does it constitute advertising or a solicitation. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.

2024 Citizens Financial Group, Inc. All rights reserved. Citizens is a brand name of Citizens Bank, N.A. (NMLS ID# 433960). Member FDIC