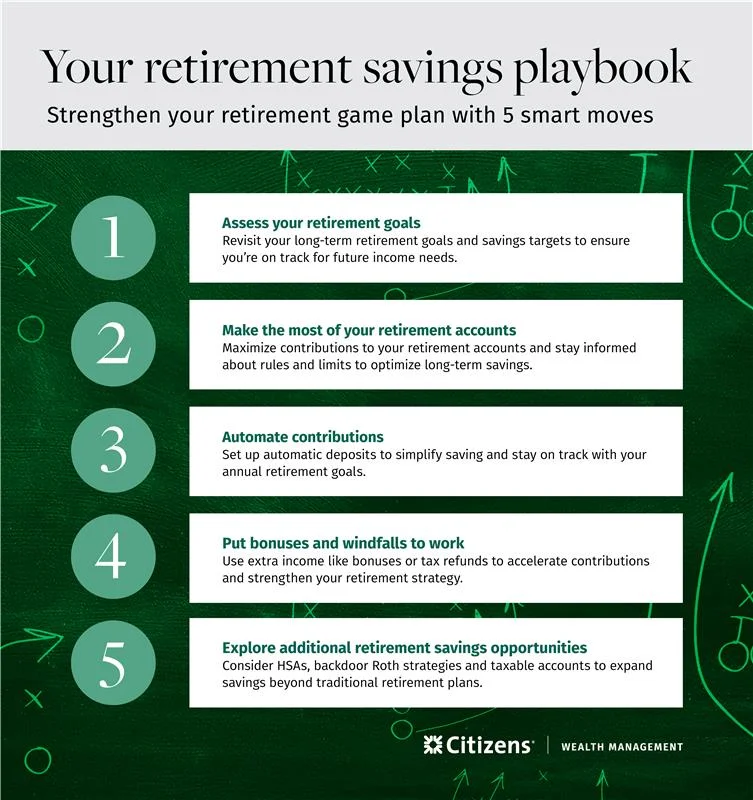

Your retirement savings playbook: 5 smart moves for 2026

By Jason R. Friday, CFP®, MPAS®, RICP®, CMFC, Head of Financial Planning | Citizens Wealth Management

Key takeaways

- Start the year by reviewing retirement goals and savings targets to ensure you’re on track for future income needs.

- Consider how to take advantage of higher contribution limits in 2026 to maximize tax-efficient retirement savings opportunities.

- Explore automating contributions and using bonuses or windfalls strategically to strengthen your retirement plan.

Whether you're decades from retirement or nearing the finish line, now is the perfect time to take control of your future. The start of a new year is ideal for reviewing your retirement plan, especially as new rules and higher contribution limits take effect in 2026.

Explore this retirement planning playbook for five smart moves to help you make the most of the year ahead.

1. Assess your retirement goals

Before determining your 2026 plan, revisit your long-term retirement goals to confirm you’re on track. Your retirement savings target should be based on personal factors, including:

- Your retirement age and timeline

- Estimated annual income needs in retirement

- Other retirement income sources such as Social Security or pensions

For example, suppose your goal is to retire in 10 years at age 65 with a starting annual retirement income of $125,000. You estimate that Social Security will provide $40,000 annually, leaving $85,000 to come from your savings. Using a basic withdrawal guideline like the 4% rule, that translates to a retirement savings goal of roughly $2.1 million.

Based on this target, you can compare your current savings, projected contributions and potential growth against that goal to see if you are on track. If you’re behind, you can consider increasing contributions, adjusting your retirement timeline or revisiting your retirement income needs.

While general guidelines and estimates are helpful, a financial advisor can provide a much more detailed, comprehensive retirement analysis for greater confidence.

2. Make the most of your retirement accounts

Once you’ve set your long-term goals, consider how to maximize your retirement plan contributions. Higher annual contribution limits1 for 2026 create an opportunity to save more:

Workplace plans (401(k) and 403(b)):

- Under 50: $24,500

- 50 or older catch-up: Additional $8,000 (total $32,500)

- Ages 60 to 63 “super” catch-up: Additional $11,250 (total $35,750)

Individual retirement accounts (IRAs):

- Under 50: $7,500

- 50 or older catch-up: Additional $1,100 (total $8,600)

Beyond the contribution limits, keep these rules in mind:

Income restrictions: IRAs have income limits. In 2026, eligibility to contribute to a Roth IRA phases out if you are single with an adjusted gross income (AGI) between $153,000 – $168,000, or married filing jointly between $242,000 – $252,000. There are also limits on claiming the traditional IRA tax deduction if you or your spouse are covered by a workplace retirement account.

New Roth catch-up rule: For workplace retirement plans, there’s a new rule for catch-up contributions starting in 2026.2 Those who earned more than $150,000 in 2025 will be required to make any catch-up contributions on a Roth basis, meaning you pay taxes now but may have tax-free withdrawals in retirement. However, you can still make standard pre-tax contributions before reaching the catch-up limits.

3. Automate contributions

Automating contributions is a simple, effective way to stay on track with your goals. Once you know how much you want to contribute to your retirement accounts for the year, you can easily determine the amount needed per month or per paycheck.

For example, if your goal is to contribute $24,500 to your 401(k), you could set up automatic contributions that would equate to $471 per week or $942 bi-weekly. This eliminates the need to make ongoing decisions about contributions throughout the year.

If you’re already automating but not maxing out your plans, consider making an incremental increase. For example, if you were saving 10% of your salary in 2025, try increasing it to 11% in 2026.

4. Put bonuses and windfalls to work

Year-end bonuses, tax refunds or unexpected cash can provide a boost to your retirement strategy or a head start on your annual savings goals. Consider using these funds to:

Max out contributions: Extra dollars may enable you reach the higher 2026 limits faster, especially if you are aiming to fully fund your 401(k) or IRA.

Utilize catch-up opportunities: If you’re 50 or older, a bonus or windfall can help you make the most of expanded catch-up limits.

Build tax-free retirement income: Allocating some of your windfall to Roth contributions could help keep you in a lower tax bracket in retirement or limit taxes on Social Security and Medicare surcharges.

A strategic approach now could strengthen your financial future in retirement.

5. Explore additional retirement savings opportunities

Beyond your typical retirement plan contributions, here are other opportunities to consider.

Health savings accounts

A health savings account (HSA) lets you save for future health care expenses with three tax advantages:

- Your contributions are tax-deductible today

- Any investment growth in the account is tax-deferred

- Withdrawals to pay for qualified health care expenses are tax-free

HSAs can also support retirement planning. Before age 65, non-qualified withdrawals incur a 20% penalty in addition to any income taxes owed. However, after age 65, you can use HSA funds for any expense without owing a penalty, though income taxes still apply.3 You can also continue to use HSA dollars tax-free on eligible health care expenses in retirement.

Backdoor Roth IRA

If your income exceeds Roth IRA limits, a backdoor Roth IRA may offer an alternative way to build tax-free retirement savings. You make a nondeductible contribution to a traditional IRA and then immediately convert those funds to a Roth IRA.

There are no income restrictions for making conversions, and the result is identical to if you had contributed directly to a Roth IRA.

Before using this strategy, pay attention to the pro rata rule. If you already have pre-tax balances in traditional IRAs, those could lead to taxes when you make conversions for a backdoor Roth IRA. Before proceeding, review this strategy with a financial advisor and tax professional.

Mega backdoor Roth

A mega backdoor Roth is a strategy where you make after-tax contributions to a 401(k) and then convert them to a Roth account such as a Roth IRA or Roth 401(k).

To utilize this strategy, your workplace retirement plan must allow:

- After-tax contributions

- In-service withdrawals of after-tax contributions or in-plan Roth conversions

This strategy can be complex and is generally only useful for those who already max out their 401(k) contributions and can't contribute to a Roth IRA directly. You should consult your plan administrator, financial advisor and tax professional to see if it makes sense for your situation.

Taxable brokerage accounts

Regular brokerage accounts can also help you save for retirement. While they don't provide the same tax advantages of retirement accounts, they have fewer restrictions, such as no contribution limits or early withdrawal penalties.

Take control of your retirement planning

Now is the perfect time to start securing your financial future. The year ahead offers meaningful opportunities for retirement savers — from higher contribution limits to strategies that can help you optimize your plans.

For personalized guidance tailored to your retirement goals, connect with a dedicated Citizens Wealth Advisor* today.

Related topics

How will you generate your retirement income? 6 key sources explained

It's important to create a well-balanced mix of income streams to support you throughout retirement.

Hidden costs in retirement: 6 unexpected expenses for retirees

A strong retirement plan addresses both the obvious and often overlooked expenses that can cut into your retirement budget.

8 Common investing mistakes

Refine your strategy by understanding common investing mistakes and best practices to help you avoid them.

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

1 IRS, "401(k) limit increases to $24,500 for 2026, IRA limit increases to $7,500," Nov. 2025

2 IRS, "Treasury, IRS issue final regulations on new Roth catch-up rule, other SECURE 2.0 Act provisions” and "IRS Notice 2025-67"

3 Congress.gov, "Health Savings Accounts (HSAs)," Feb. 2025

* Securities, Insurance Products and Investment Advisory Services offered through Citizens Wealth Management.

Disclaimer: Citizens Securities, Inc. and Clarfeld Financial Advisors, LLC do not provide legal or tax advice. The information contained herein is for informational purposes only as a service to the public and is not legal advice or a substitute for legal counsel. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.

Banking products are offered through Citizens Bank, N.A. ("CBNA"). For deposit products, Member FDIC.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the U.S., which it authorizes use of, by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

All investing involves risk, including the risk of loss of principal. Investment risk exists with equity, fixed income, and other marketable securities. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Citizens Wealth Management (in certain instances DBA Citizens Private Wealth) is a division of Citizens Bank, N.A. ("Citizens"). Securities, insurance, brokerage services, and investment advisory services offered by Citizens Securities, Inc. ("CSI"), a registered broker-dealer and SEC registered investment adviser - Member FINRA/SIPC. Investment advisory services may also be offered by Clarfeld Financial Advisors, LLC ("CFA"), an SEC registered investment adviser, or by unaffiliated members of FINRA and SIPC providing brokerage and custody services to CFA clients (see Form ADV for details). Insurance products may also be offered by Estate Preservation Services, LLC ("EPS") or an unaffiliated party. CSI, CFA and EPS are affiliates of Citizens. Banking products and trust services offered by Citizens.

SECURITIES, INVESTMENTS AND INSURANCE PRODUCTS ARE SUBJECT TO RISK, INCLUDING PRINCIPAL AMOUNT INVESTED, AND ARE:

· NOT FDIC INSURED · NOT BANK GUARANTEED · NOT A DEPOSIT · NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY · MAY LOSE VALUE