Powerful voices empowering women to thrive

By Gina Gallagher | Citizens Contributor

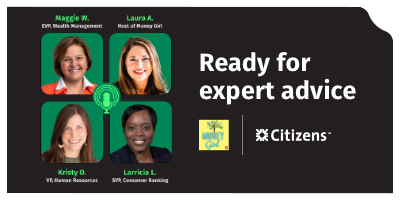

On an episode of the acclaimed Money Girl podcast, three inspiring leaders from Citizens joined host Laura Adams to share personal stories, experiences and advice in hopes to empower women to thrive professionally and financially.

We heard from Kristy Olinger, Vice President, Human Resources, Maggie Wall, Executive Vice President, Wealth Management, and Larricia Lumpkins, Senior Vice President, Consumer Banking.

Here is some of the wisdom they shared:

Knowing your value at work

-

“Women have the tendency to work hard, put their heads down and think they’re going to come to me with the next opportunity,” she shares. “You can’t expect that … be very clear about what you want and ask for it.”

Maggie Wall

Executive Vice President, Wealth Management

The income we earn is the foundation of our financial success. But how can women maximize their earnings and get the opportunities they deserve? Kristy Olinger, Vice President, in Human Resources, knows a great place to start: by knowing your worth. Kristy shared a story of how earlier in her career she discovered a direct report was making 30% more than she was. It would prove to be valuable learning experience.

“I realized I had deep financial acumen but really lacked the context and information I needed to advocate for myself financially.” That’s why Kristy often encourages women to have frank conversations with others about what they earn. “I grew up hearing that it was impolite to talk about money, but the best way to understand your worth is to be willing to talk about money with the people around you.”

Realizing our value at work can be a challenge for women in other ways, notably when opportunities arise to “sit at a bigger table” as Larricia Lumpkins, Senior Vice President, Consumer Banking, explains. “As women, we often spend our time trying to validate whether we belong at the table,” she shares. “When given opportunities to interact with higher-level individuals, we need to throw our shoulders back and understand that we are there because we have something to add.”

Maggie Wall, Executive Vice President, Wealth Management, shared another challenge that impacted her early in her career: asking for what you want. “Women have the tendency to work hard, put their heads down and think they’re going to come to me with the next opportunity,” she shares. “You can’t expect that … be very clear about what you want and ask for it.”

Building financial confidence

-

“Don’t be afraid to have an authentic conversation with someone who may be a few steps ahead of you financially. You may find out that they have a lot of the same questions you do and may be able to show you how they navigated that situation.”

Larricia Lumpkins

Senior Vice President, Consumer Banking

The decisions involved with managing money can be daunting, whether it involves saving to build a financial foundation or managing wealth once we have it. The key to achieving success lies in developing financial confidence. According to Kristy, that confidence can come from knowledge and leaning in to the range of resources available like the Money Girl podcast.

Maggie believes that confidence comes from moving forward even when you’re uncomfortable or scared.

“Look, there’s nothing more scary than finances and wondering am I making the right decisions about where I should go?,” she shares. “As you move towards those decisions, you find out more information … and the more confident you will get.”

Larricia agrees that “competence builds confidence” and encourages women to find financial mentors who can guide us. “As women, we may have a person that we admire who maybe is a couple of steps ahead of us financially,” she offers. “Don’t be afraid to have an authentic conversation. You may find out that they have a lot of the same questions you do and may be able to show you how they navigated that situation.”

Host Laura Adams believes that “having those conversations and being vulnerable” is where learning starts. Vulnerability often means knowing when to ask for help, including getting assistance from a financial advisor.

Managing our financial responsibilities

“Saving for a home, education, retirement can be absolutely daunting. Saving in small chunks for those goals made a difference over a long period of time,” said Maggie Wall Executive Vice President, Wealth Management.

Another financial challenge for women is knowing how to prioritize their financial responsibilities, particularly if they have the added responsibility of managing family finances as Maggie did earlier in her career.

“The whole thought of saving for my home, my children’s education, retirement, was absolutely daunting and overwhelming,” she says.

One of the simplest decisions she made was to have automatic pay deductions to save a small amount of money a week for her children’s college. “Those small chunks made a difference over a long period of time,” she offers.

Changing roles and perceptions of success

-

“Women can change their mental models between gender and money and replace them with new ones.”

Kristy Olinger

Vice President, Human Resources

There’s no question that women have very unique challenges and perceptions when it comes to managing their money and their careers. Kristy believes that we have the power to change, as these inspiring women have done.

“There has been a mental model that most women carry between genders and money where men are breadwinners and women are caretakers of the household. We can change our models and replace them with new ones.”

Ready to take charge of your financial life?

At Citizens, we can help you get more out of your money and reach your goals with a full range of solutions, helpful resources and personal guidance every step of the way.

Related topics

Community

Strengthening the communities where we live and work. That's what Citizens Helping Citizens is all about.

Diversity, Equity & Inclusion

Learn about our commitment to diversity and inclusion, specifically in the areas of employment and suppliers.

Corporate Responsibility

Our commitment to continual environmental, social and governance (ESG) progress is woven into the fabric of our business, as we work to create a thriving, sustainable, inclusive future for all of our stakeholders.

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

Disclaimer: The information contained herein is for informational purposes only as a service to the public and is not legal advice or a substitute for legal counsel. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.