Generation rewrite: More young adults are defining success on their own terms

Young adults today are navigating a dynamic economic landscape as they manage expectations for what they want life to look like. To better understand their mindset and how they think and feel about money, Citizens polled 2,300 people between the ages of 18 and 34 about their finances, careers and overall life goals.

In Citizens' Next Gen: Future of Success Survey, what emerged is a portrait of a generation that prioritizes stability, freedom and purpose. They are ambitious, value-driven and intent on building strong financial foundations on their own terms. But while their goals are clear, the path forward can feel uncertain. To truly support this generation, financial partners must evolve by offering tools, personalized guidance and solutions that meet them where they are and grow with them.

Clearing a path to financial wellness

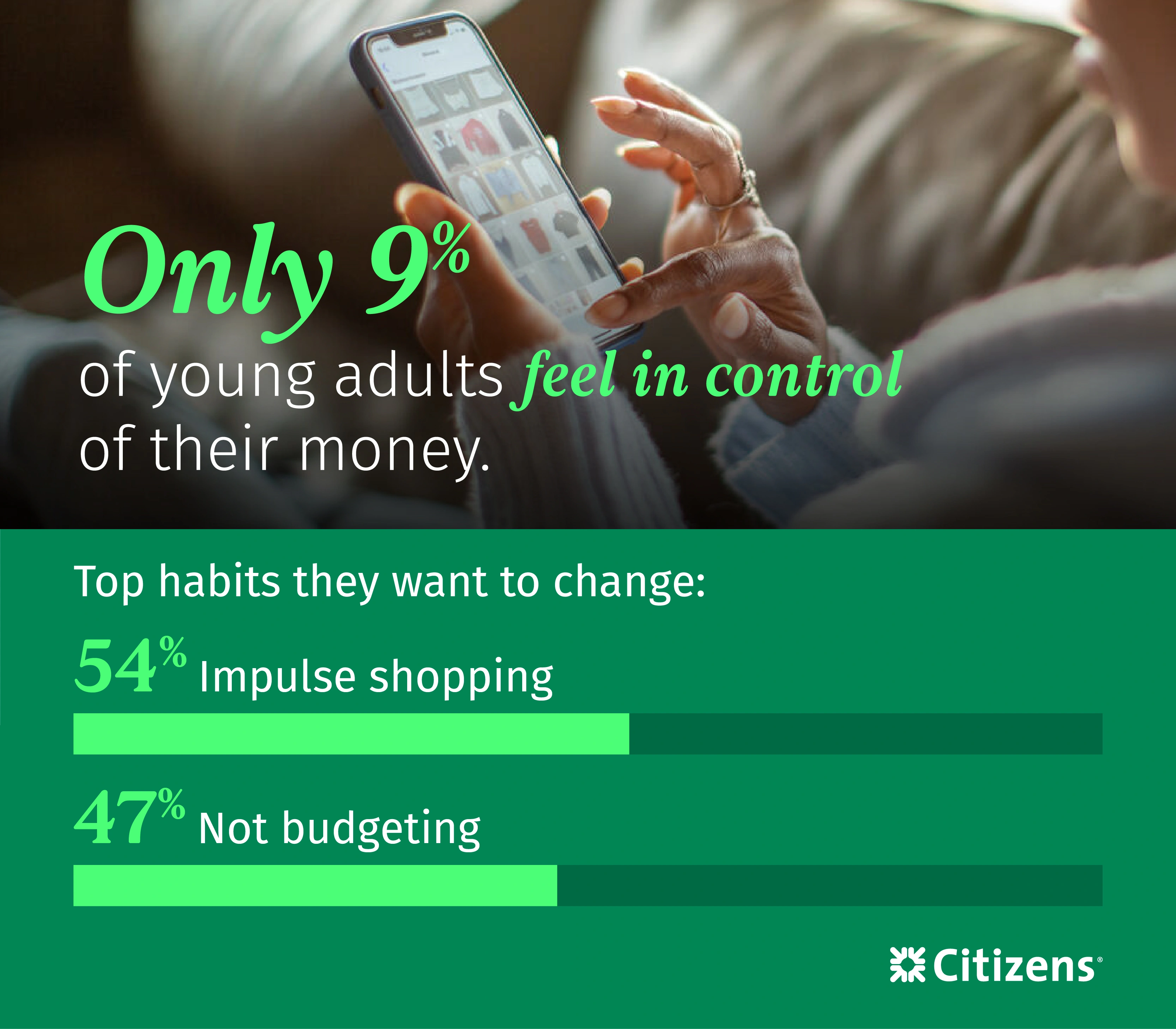

Only 9% of young adults feel fully in control of their spending. Our survey also found that 54% cited impulse shopping as a challenge, and 47% admitted they don't budget.

These Gen Z and young millennial financial habits aren't just about dollars and cents. They impact overall self-esteem. More than half (57%) say stress about money affects their mental health, and 44% succumb to social pressures that influence their overspending. More than two-thirds (68%) still lean on their parents for essentials like rent, groceries and bills. Only 15% are extremely confident in their ability to achieve financial success.

Trusted expertise can make all the difference as young people navigate their financial journey and strengthen their financial resilience. Citizens helps foster these positive financial habits through smarter digital tools, personalized support and access to resources to turn goals into reality.

Matt Boss

Head of Consumer Banking at Citizens

Lay solid financial groundwork

Changing financial habits is a meaningful step toward greater stability and confidence. The right tools for budgeting, saving and managing debt can turn financial stress into financial strength.

4 budgeting strategies: Which one is right for you?

Choose a budgeting method that fits your habits and goals.

How to plan for short- and long-term saving goals

Set realistic milestones and stay on track with your savings goals.

Managing debt and debt payoff

Discover simple steps to reduce debt and build financial confidence.

Redefining personal and financial success

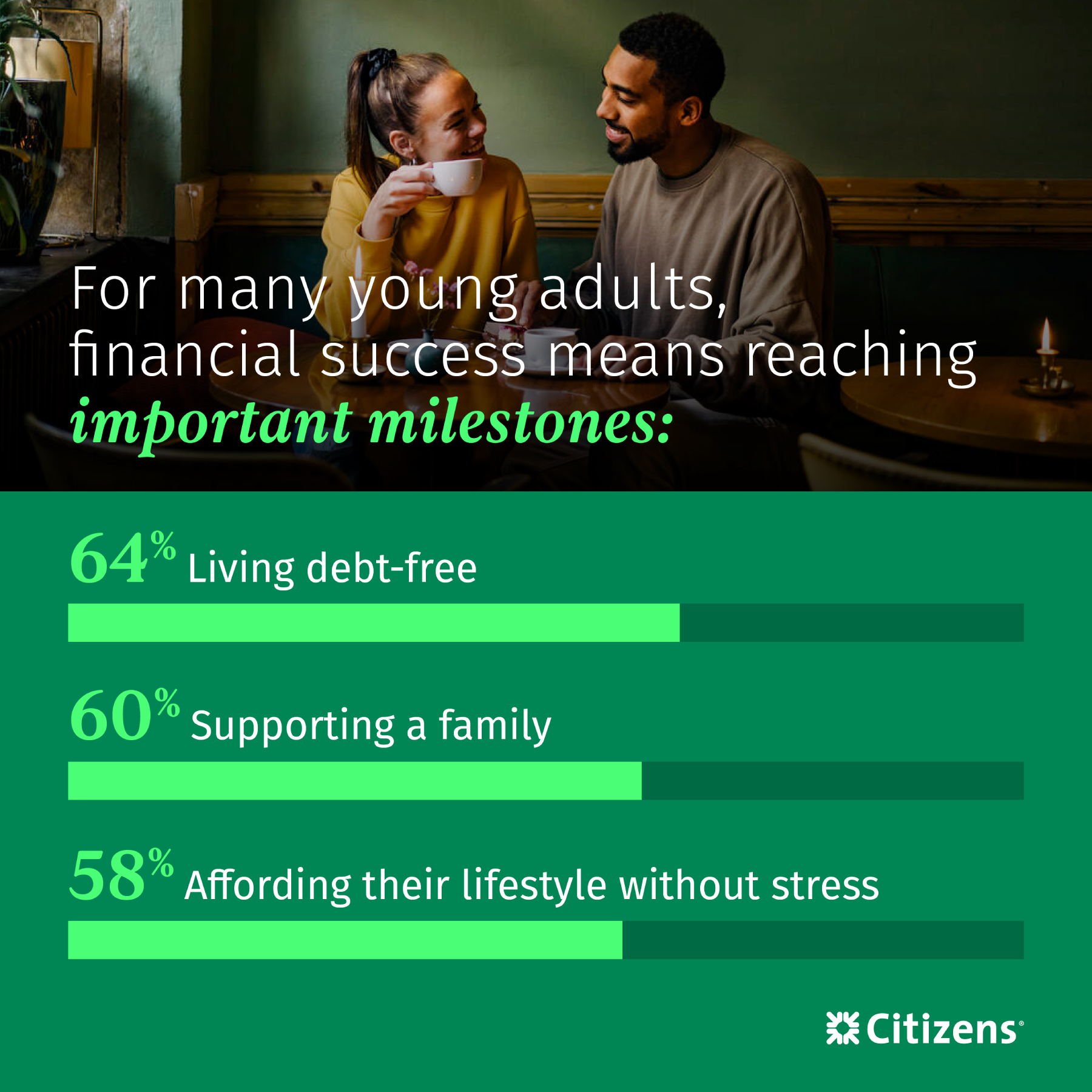

Today's young adults define personal success by self-sufficiency and living a life that reflects their values. Our survey found that top milestones include living debt-free (64%), supporting a family (60%) and affording their lifestyle without stress (58%).

The pursuit for more freedom and balance is both personal and professional. Gen Z and young millennials are defining career success by financial independence (52%), work-life balance (50%) and building valuable skills (44%).

Young adults want to live better, not just earn more. That means rethinking how we support their idea of success. Citizens provides more than just a place to store money. We have the insights, education and advice that help them build the life they've imagined.

Mark Valentino

Head of Business Banking at Citizens

Sharpen your financial focus

Young adults want stability, but not at the cost of growth and freedom. Get access to tailored tools and insights to navigate important life milestones.

Citizens Student Hub

Discover tips, tools and resources for students looking for financial support.

Student loans and marriage

Learn how to manage student loans with practical advice for couples planning a future.

How to buy a house: A step-by-step guide

Demystify the home buying process.

Chasing bold professional goals

For this generation, ambition isn't in short supply. As young adults seek purpose and independence, more than two-thirds, or 67%, are pursuing entrepreneurship. And they're thinking big, with 60% hoping to eventually sell or take their company public.

But many are unsure where to begin (36%) or how to fund their ideas (37%). Gen Z and young millennials alike are looking for more than motivation — they want actionable advice and access to funding. Today's young entrepreneurs are seeking support in the form of business banking tools (37%), credit card and payment services (36%), access to funding (35%) and help managing cash flow and working capital (34%).

Ownership offers benefits like purpose and control, but starting out can feel daunting. Citizens provides access to credit, payment solutions, cash management tools, and expert advice to help young entrepreneurs turn ambition into action.

Mark Valentino

Head of Business Banking at Citizens

Launch your business on stable footing

Young entrepreneurs don't have to do it alone. Whether it's taking a side hustle full time or scaling a business, resources should scale with your goals.

Tips for starting a small business

Learn how to get your business off the ground.

Finding your work-life balance

Gain practical tips for blending ambition with wellness.

Where to find small business advice

From funding to networking, these resources will help you grow your business.

Forging trusted financial partnerships

Today's young adults want more than digital convenience. They want a financial partner.

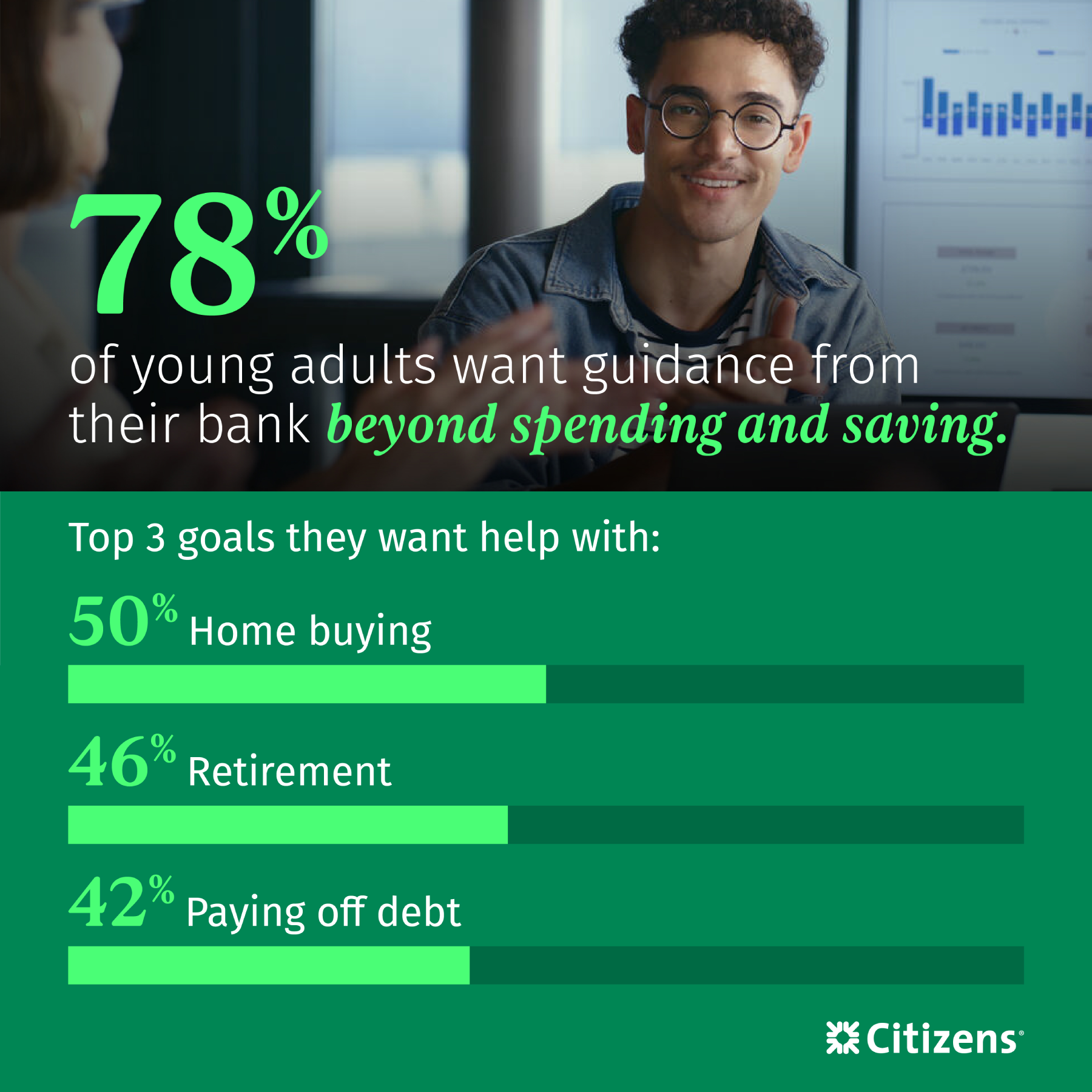

Our survey found that 78% of young adults say they need help beyond basic banking. They're seeking guidance on big life goals like buying a home (50%), saving for retirement (46%) and paying off long-term debt (42%).

This generation isn't just looking for answers — they value meaningful connection, especially when navigating major financial decisions. While 91% of those surveyed use digital tools to manage money, only 10% want a fully digital experience. Most desire a hybrid approach that includes human support for major milestones like opening accounts (41%) and making large transactions (37%).

Young adults define success as security, not extravagance. But they also understand they need tools, coaching and guidance to help them get there. As Gen Z and young millennials work toward their goals, Citizens remains committed to providing them with the assistance they need to grow and thrive.

Matt Boss

Head of Consumer Banking at Citizens

When you have questions, we have answers

From making a plan to sticking with it, Citizens is ready to help you make sense of your money.

Managing your finances: Money management tips

Lay the groundwork for saving, budgeting and managing debt.

Starting a business: Small business insights

Discover the ins and outs of starting and running a successful business.

Financial planning tips and advice

Find resources to help you build a solid financial planning foundation.

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

Citizens' Next Gen: Future of Success Survey was conducted by Researchscape among 2,309 U.S. adults aged 18-34. The survey was fielded from August 29 to September 11, 2025, using an online survey. Data has been weighted. Weighting data is a statistical technique used to adjust survey data after it has been collected in order to improve the accuracy of survey estimates.

Disclaimer: The information contained herein is for informational purposes only as a service to the public and is not legal advice or a substitute for legal counsel. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.

Citizens Wealth Management: Citizens Wealth Management (in certain instances DBA Citizens Private Wealth) is a division of Citizens Bank, N.A. ("Citizens"). Securities, insurance, brokerage services, and investment advisory services offered by Citizens Securities, Inc. ("CSI"), a registered broker-dealer and SEC registered investment adviser - Member FINRA / SIPC. Investment advisory services may also be offered by Clarfeld Financial Advisors, LLC ("CFA"), an SEC registered investment adviser, or by unaffiliated members of FINRA and SIPC providing brokerage and custody services to CFA clients (see Form ADV for details). Insurance products may also be offered by Estate Preservation Services, LLC ("EPS") or an unaffiliated party. CSI, CFA and EPS are affiliates of Citizens. Banking products and trust services offered by Citizens.

SECURITIES, INVESTMENTS AND INSURANCE PRODUCTS ARE SUBJECT TO RISK, INCLUDING PRINCIPAL AMOUNT INVESTED, AND ARE:

· NOT FDIC INSURED · NOT BANK GUARANTEED · NOT A DEPOSIT · NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY · MAY LOSE VALUE

![]() Equal Housing Lender.

Equal Housing Lender.