Insurance planning essentials: protecting your family's financial future

By Nelson Rivera, CPA, Head of Insurance | Citizens Wealth Management

Key takeaways

- Insurance can help protect families from financial risks that may be difficult to manage alone.

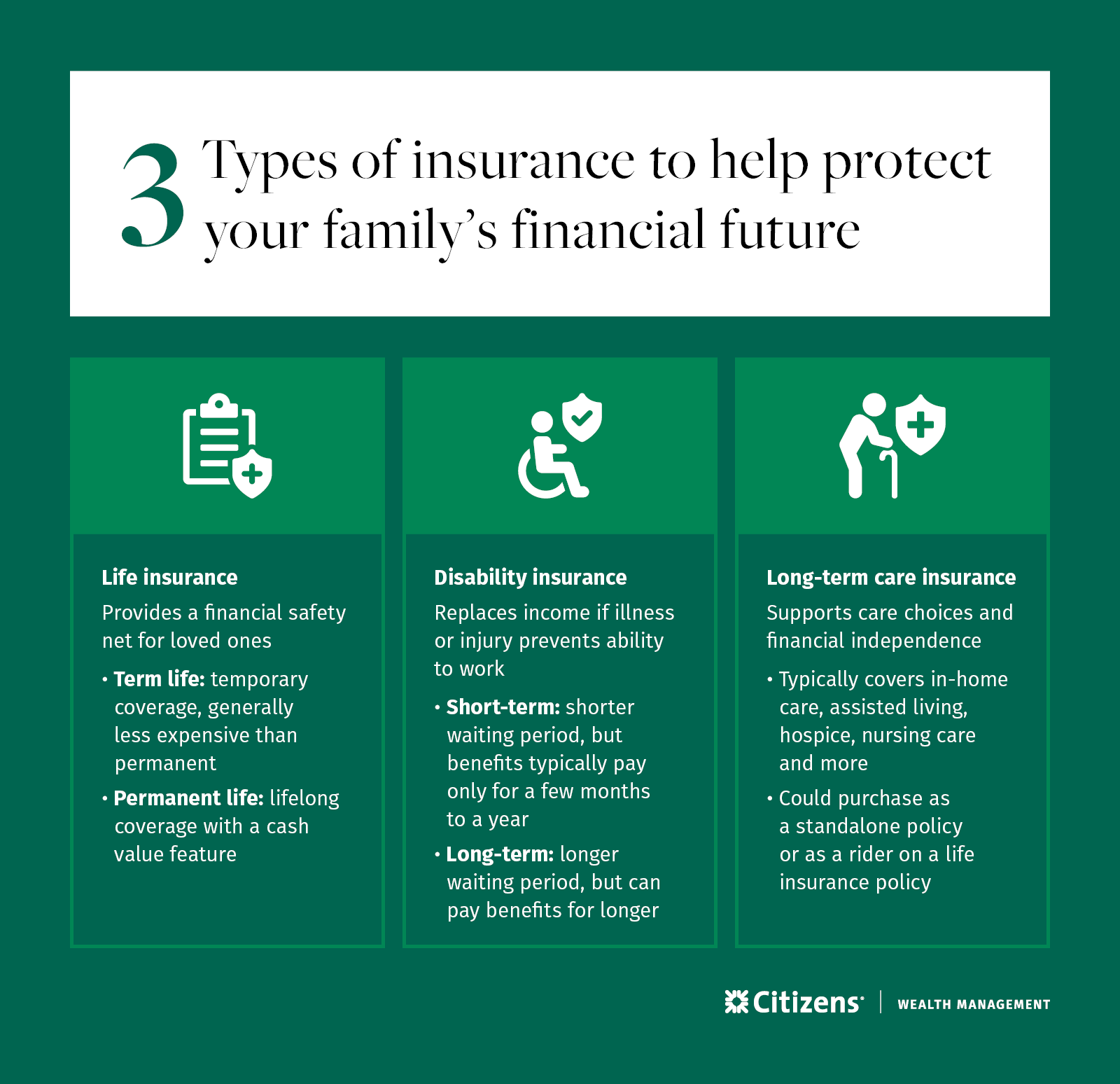

- Life, disability, and long-term care insurance are key types to consider in a comprehensive financial plan.

- Coverage needs vary by family, so it's important to tailor insurance choices to your goals and budget.

When it comes to protecting your family's financial future, insurance plays a vital role. While most people carry basic coverage like auto, homeowners, and health insurance, there are other types of insurance that can help fill critical gaps and strengthen your overall financial security.

Here's a closer look at several types of insurance worth considering and how they can support your long-term financial goals.

Life insurance: a foundation for family protection

Life insurance provides a financial safety net for your loved ones in the event of your passing. With a life insurance policy in force, your beneficiaries receive a death benefit that can help repay debt, replace lost income, and support future goals such as funding college education or retirement.

There are two primary types:

- Term life insurance: This type offers coverage for a set period, such as 10, 20, or 30 years. It's generally the more affordable option and ideal for temporary needs like covering a mortgage or paying for childcare expenses.

- Permanent life insurance: This type provides lifelong coverage and may build cash value over time. This cash value can be borrowed against or used to supplement retirement income, offering flexibility as your financial needs evolve.

You can also customize policies with riders, such as child term coverage or long-term care benefits. These additions can enhance the policy's usefulness and ensure it adapts to your family's changing needs.

For business owners, having the right life insurance in place is essential for protecting both your company and personal financial interests. Key person insurance helps safeguard the business if a critical employee or owner passes away. Buy-sell agreements funded by life insurance are also important for ensuring smooth ownership transitions.

Disability insurance: income protection when you need it most

If an illness or injury prevents you from working, disability insurance can help replace lost income and maintain financial stability. This coverage is especially important for working professionals, parents, and business owners who rely on their income to support their lifestyle and financial obligations.

Most disability insurance policies are designed to replace 40% to 80% of your salary. The right coverage amount for you depends on your monthly expenses and how long you could manage without income.

You should also consider the tax treatment of disability benefits. If you pay for an individual policy with after-tax dollars, the benefits are generally tax-free. If your coverage is provided through your employer (known as group disability insurance), the benefits are typically taxable.

There are two main types of disability insurance:

- Short-term disability insurance: These policies begin paying benefits usually within a few days or weeks of a covered event and continue for only a few months to a year. It's intended to cover temporary conditions, like recovering from surgery.

- Long-term disability insurance: These policies have a longer waiting period (usually 90 to 180 days) but can provide benefits for years or even until retirement age. This type of coverage is essential for protecting against more serious or lasting health issues.

Be sure to review your employer's disability coverage to understand what's included. You may need to supplement it with an individual short- or long-term disability policy to ensure you have appropriate protection.

Long-term care insurance: preserving independence and your finances

Long-term care insurance is often misunderstood as coverage that only applies to nursing home care. In reality, it can help pay for a wide range of services such as in-home care, adult day care, assisted living, and hospice care. This type of insurance is especially valuable for those who want to maintain independence and have more control over where and how they receive care.

In general, it's best to purchase coverage in your 50s or early 60s, before premiums become more expensive and health qualifications become more restrictive. If you have a family history of conditions like dementia or chronic illness, it may be wise to act sooner.

When evaluating policies, consider:

- Daily benefit amount: This refers to the specific amount the policy will pay per day for care.

- Benefit period: This defines the total length of time benefits will be paid under the policy.

- Elimination period: This is the waiting period that must pass after a claim is filed before benefits begin.

- Inflation protection: This is an optional feature that can help your benefits keep pace with rising care costs.

You may be able to purchase long-term care insurance as a standalone policy or as a rider on a life insurance policy. You can talk to a financial advisor to explore which option fits your needs and budget.

Insurance planning with purpose

Insurance is not just about protecting income or assets. It's about creating financial confidence and ensuring loved ones or business partners are supported, no matter what life brings.

The most effective strategies come from asking the right questions, staying proactive with policy reviews, and working with trusted professionals who understand both the products and the people they serve.

A Citizens Wealth Advisor* can help you evaluate your financial plan and identify coverage options that make sense for your situation. Connect with a Citizens Wealth Advisor today to go over your insurance options and take meaningful steps to protect your financial future.

Related topics

Financial planning tips for older adults and their families

If you're looking for a way to bring yourself and your family a sense of comfort as the years pass, look no further than your financial plan.

A guide to estate planning

It's never too early to get started on an estate plan. Learn the seven key steps to create one.

Hidden retirement costs: 6 unexpected expenses for retirees

A strong retirement plan addresses both the obvious and often-overlooked expenses that can cut into your retirement budget.

© Citizens Financial Group, Inc. All rights reserved. Citizens Bank, N.A. Member FDIC

* Securities, Insurance Products and Investment Advisory Services offered through Citizens Wealth Management.

Disclaimer: Citizens Securities, Inc. and Clarfeld Financial Advisors, LLC do not provide legal or tax advice. The information contained herein is for informational purposes only as a service to the public and is not legal advice or a substitute for legal counsel. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.

Insurance products are made available through Citizens Securities, Inc., a licensed insurance agency, doing business as Citizens Financial and Insurance Agency. CA Insurance License OL81568

Insurance contracts may contain exclusions, limitations, reductions of benefits and terms for keeping them in force.

Banking products are offered through Citizens Bank, N.A. ("CBNA"). For deposit products, Member FDIC.

All investing involves risk, including the risk of loss of principal. Investment risk exists with equity, fixed income, and other marketable securities. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Citizens Wealth Management (in certain instances DBA Citizens Private Wealth) is a division of Citizens Bank, N.A. ("Citizens"). Securities, insurance, brokerage services, and investment advisory services offered by Citizens Securities, Inc. ("CSI"), a registered broker-dealer and SEC registered investment adviser - Member FINRA/SIPC. Investment advisory services may also be offered by Clarfeld Financial Advisors, LLC ("CFA"), an SEC registered investment adviser, or by unaffiliated members of FINRA and SIPC providing brokerage and custody services to CFA clients (see Form ADV for details). Insurance products may also be offered by Estate Preservation Services, LLC ("EPS") or an unaffiliated party. CSI, CFA and EPS are affiliates of Citizens. Banking products and trust services offered by Citizens.

SECURITIES, INVESTMENTS AND INSURANCE PRODUCTS ARE SUBJECT TO RISK, INCLUDING PRINCIPAL AMOUNT INVESTED, AND ARE:

· NOT FDIC INSURED · NOT BANK GUARANTEED · NOT A DEPOSIT · NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY · MAY LOSE VALUE